FOI 3812

Pages that are out of scope in full and/or exempt

Document 1

in full have been deleted from the document set

Background – KPMG il icit tobacco report 2017

• KPMG’s Illicit Tobacco in Australia Report, commissioned by Phillip Morris and Imperial

Tobacco, estimates that il icit tobacco cost the Government around $1.91 bil ion in forgone

revenue in 2017.

• The estimate is of a similar magnitude to recent KPMG estimates of the size of the illicit

tobacco market.

• According to the KPMG Report:

o Total consumption of illicit tobacco declined by 1.0 per cent. However, this

represents an increase in the proportion of illicit consumption because legal

consumption decreased by around 6 per cent.

o Contraband consumption accounted for the majority of total il icit tobacco

consumption at 51.1 per cent of the total. Contraband refers to cigarettes

manufactured legal y outside of Australia and smuggled into the country.

• Key quote: “We believe there is no denying the link between high excise and the il icit

market. As excise on tobacco contributes to increased prices, the attractiveness of the il icit

market becomes even more obvious to serious and organised crime”.

Defensive talking points

Impact of excise on the size of the illicit market

• The il icit market is driven by a multitude of factors of which the excise duty rate is only one.

• Tobacco excise is among the most effective interventions to reduce the prevalence of

smoking and protect the health of Australians.

• Australia’s tobacco excise rates are below the World Health Organisation’s recommended

level. As of 1 September 2017, tobacco excise was estimated to account for between 53 and

62 per cent of the retail price of manufactured cigarettes compared with the WHO’s

recommendation of 70 per cent.

Difference between the Government’s estimate and the KPMG report

• The ATO and Home Affairs estimate of the revenue impact of illicit tobacco is approximately

$600 million per year.

• Though this estimate is significantly lower than the KPMG estimate, any loss of revenue is a

serious issue and even more so given the involvement of organised crime in the il icit

tobacco market.

• The estimates by the ATO and Home Affairs are based on extensive and high quality data

held by these agencies, and use a methodology endorsed by independent experts.

o The supply-side methodology used by the ATO and Home Affairs has been endorsed

by an independent expert panel, comprising: Professor Neil Warren (Professor of

Taxation at the University of New South Wales), Mr Richard Highfield (Adjunct

Professor with the School of Taxation and Business at the University of New South

Wales) and Mr Saul Eslake (Vice Chancellor’s fellows at the University of Tasmania).

• Some aspects of the KMPG methodology are considered to be prone to variance such as:

o The use of empty packet analysis, as it is impossible to estimate and adjust for

legitimate overseas imports and the duty free al owance for international air

passengers.

o Questionnaires and surveys suffer from misinterpretation and error.

• Notwithstanding the difference in estimates, the Government agrees that a coordinated

strategy is needed to combat illicit tobacco. That is why we are introducing a

comprehensive illicit tobacco package, including the creation of the Illicit Tobacco Taskforce,

which will combine the resources and capabilities of a number of law enforcement and

border security agencies.

FOI 3812

Document 2

BACK POCKET BRIEF – Illicit tobacco

Budget measures

2018-19 Budget measures (BP2 pg.12)

• From 1 July 2019, tobacco importers wil be required to pay excise when tobacco enters the

country, rather than when it enters the domestic market, eliminating leakage from warehouses to

the black market.

• From 1 July 2018, a new multi-agency Il icit Tobacco Taskforce, led by the Australian Border

Force (ABF).

o The Taskforce wil leverage whole-of-government capabilities and powers

from multiple agencies to investigate, prosecute and ultimately dismantle the

international organised crime groups responsible for a large part of the ilicit

tobacco trade.

• From 1 July 2018, the ATO wil be provided with additional resources, including an additional

six investigators, to fight domestic il icit tobacco crops.

• From 1 July 2019, permits wil be required for al tobacco importations, assisting border officers

to quickly and efficiently determine when an offence has been committed.

o This wil deter the trade in il icit tobacco by providing the ABF with new

enforcement options to seize il icit tobacco and infringe its importers more easily.

• Beginning 2020-21, the ATO wil upgrade and future-proof its excise and excise equivalent

goods payment systems to replace the outdated paper lodgement system.

• Moving the tax point will

require legislation.

2017-18 Budget measures:

•

Consistent duty calculation was introduced for cigars and ‘roll your own’ tobacco products.

o The amendments ensure that cigarettes and ‘roll your own’ tobacco products receive

comparable tax treatment.

2016-17 Budget measures:

•

Increase in excise on al tobacco by 12.5 per cent commenced on 1 September 2017, with three

subsequent annual increases (until 2020).

• The Government agreed to

strengthen the legislative framework for illicit tobacco offences.

These wil be implemented through two pieces of legislation:

o The

Treasury Laws Amendment (Illicit Tobacco Offences) Bill - introduced to the

House of Representatives in February 2018, currently before the Senate.

o The

Customs Amendment (Illicit Tobacco Offences) Bill - introduced to the House of

Representatives in March 2018.

• The new penalties provide enforcement officers, including the ABF, with strengthened

enforcement measures to tackle the il icit tobacco trade.

• The changes wil give ABF/ATO officers the tools to better target criminals who smuggle or

grow illicit tobacco. It wil also remove current obstacles to prosecution by providing officers

with powers to enforce offences where the origin of the tobacco is unknown or difficult to prove.

s 22

Impact of excise on the illicit market

• The il icit market is driven by a multitude of factors of which the duty rate is only one.

• When costing increases to excise rates Treasury estimates the decline in demand for legal

tobacco due to behavioural responses. This decline in demand includes, for example, a reduction

in tax collections due to consumers deciding to quit smoking as wel as consumers shifting to the

illicit market.

• The exact amount that the il icit tobacco market contributes to the decline in demand cannot be

separately identified from the overal estimate.

Excise collections

• Tobacco receipts for 2016-17 were $10.45 billion.

(BP1: 5-17) • At the 2018-19 Budget tobacco receipts for 2017-18 were revised up by $140 mil ion (1.2 per

cent) to $11.5 bil ion, reflecting stronger than expected collections since MYEFO.

(BP1: 5 – 15)

FOI 3812

Document 3

Illicit tobacco – Questions and Answers

Illicit tobacco – Questions and Answers ...................................................................................................................................1

1.

What is il icit tobacco? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

2.

Why is il icit tobacco a problem?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3.

What is the Government doing to combat il icit tobacco? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2

4.

What is the budget impact of the package?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

5.

What is the tobacco Tax Gap? How does it compare with the budget estimates? . . . . . . . . . . . . . . . . . . . . . . . . . . 3

Col ecting tobacco duties and taxes at the border...................................................................................................................4

6.

What is the previous taxing process?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4

7.

What is warehouse leakage? How does it occur? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4

8.

Is this a new tax on tobacco? Wil this affect the price of tobacco? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

9.

How wil this impact the cash flow of tobacco importers? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4

10.

How did the Government prevent duty evasion ahead of the change in tax point? . . . . . . . . . . . . . . . . . . . . . . . . . 5

11.

What impact wil this have on the underbond warehousing industry? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .5

12.

What consultation was undertaken with the industry?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

The Taskforce and Permits System ...........................................................................................................................................6

13.

How does the permit system work? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6

14.

What are the Il icit Tobacco Task Force’s capabilities and powers? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

15.

What is the impact on tobacconists, duty free stores and other small retailers/consumers? . . . . . . . . . . . . . . . . . .6

16.

What is the Government doing to address the delays in refunds and drawbacks for tobacco under the new

arrangements? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6

Background ...................................................................................................................................................................................7

17.

Overview of the tobacco importing industry. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

18.

What are the different tobacco types? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

19.

How much revenue is raised through tobacco duty? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

20.

What are the current excise rates for tobacco? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

21.

How is the 12.5 per cent applied? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

22.

What is the price of a pack of cigarettes, and how much is excise? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

23.

Is the il icit tobacco market a result of higher excise rates?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .8

24.

Reasons for tobacco excise (and are our tobacco taxes too high?) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .8

25.

Who has jurisdiction for combatting il icit tobacco?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .9

26.

What are the new offences in the Il icit Tobacco Offences legislation? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

27.

Why is the Government not actioning the Black Economy Taskforce recommendation regarding track-and-

trace, as noted in a recent World Bank report? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

28.

Potential registration of tobacco license holders on a public register. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

29.

KPMG ‘Il icit Tobacco in Australia’ Report 2018 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

30.

Why is the Government not actioning the Black Economy Taskforce recommendation to reduce taxes and duties

on molasses tobacco (shisha)? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

s 22

1

1. What is illicit tobacco?

Tobacco in Australia must satisfy health regulations and tobacco importers must pay duty. Il icit tobacco has

avoided these requirements and is sold to consumers through the black market.

Currently there is no legal tobacco manufacture occurring in Australia and, since 2008, no-one is licensed to

grow tobacco for commercial sale or personal use.

2. Why is illicit tobacco a problem?

Illicit tobacco is a key a source of funding for organised crime and undermines Government efforts to

improve public health outcomes by reducing the prevalence of smoking.

Law enforcement agencies have indicated that the il icit tobacco market is dominated by organised crime

groups, which use tobacco profits to fund their other criminal activities. Organised crime will continue to

operate and potential y expand if the Government does not increase resources for combatting illicit tobacco.

Il icit tobacco undermines the Government’s harm prevention efforts by providing access to tobacco at

significantly cheaper prices compared with legitimate retail sales and in some cases in counterfeit branded

rather than plain packaging.

Based on ATO and Department of Home Affairs research, illicit tobacco results in almost $600 million of

forgone tobacco duty each year. The sale of illicit tobacco also reduces tobacco sales for legitimate retailers.

3. What is the Government doing to combat illicit tobacco?

The Government has implemented its Black Economy Package – combatting illicit tobacco measure

announced in the 2018-19 Budget, which consists of five interconnected elements that target the three key

sources of illicit tobacco in Australia: smuggling; leakage from warehouses and domestic tobacco crops.

Tobacco smuggling

The Government has funded an

Il icit Tobacco Task Force from 1 July 2018. The multi-agency Task Force has

a full array of powers to effectively investigate, prosecute and ultimately dismantle the international

organised crime groups responsible for a large part of the il icit tobacco trade.

The Government has also introduced a

prohibited import control for tobacco. Since 1 July 2019, permits

have been required for al tobacco importations, assisting border officers to quickly and efficiently determine

when an offence has been committed. It wil no longer be necessary to prove concealment of tobacco and

intent to evade duty.

Leakage from warehouses

Since 1 July 2019, importers have been required to

pay al duty liabilities upon importation. Duties were

previously paid when the tobacco leaves a licensed warehouse for the domestic market. This created a risk

that criminals may seek to obtain untaxed tobacco via leakage from a warehouse before duty is paid.

Moving the tax point has eliminated warehouse leakage by incentivising importers to maintain the integrity

of the tobacco storage system and ensure the right amount of duty is paid based on the total amount of

tobacco imported.

On

25 October 2018 Royal Assent was received of Customs Amendment ((Col ecting Tobacco Duties at the

Border) Bil 2018), moving taxing point for imported tobacco to the border from 01 July 2019.

2

Domestic tobacco

The Government has funded the ATO to

combat domestic tobacco crops ($8.8 million from 2018-19 to

2021-22)

. From 1 July 2018, the Government strengthened ATO enforcement capabilities, including by

adding an additional six investigators, to tackle domestic illicit tobacco crops. This is allowing the ATO to

undertake additional activity to detect and destroy il icit tobacco and undertake fol ow up criminal

investigations.

The ATO will upgrade and future-proof its

excise and excise equivalent goods* payment systems beginning

2020-21 to replace the outdated paper lodgement system.

*Excise equivalent goods are imported goods – in this case tobacco – that are subject to customs duty at a

rate equivalent to excise duty to ensure they’re treated consistently with goods manufactured in Australia.

On

29 November 2018, Royal Assent was received of Treasury Laws Amendment ((Black Economy Taskforce

Measures No. 2) Bil 2018) and Excise Tariff Amendment ((Col ecting Tobacco Duties at Manufacture) Bil

2018) moving taxing point for domestical y manufactured tobacco (NB there is no domestic manufacturing).

4. What is the budget impact of the package?

The Package is estimated to generate a gain to budget of about $3.6 bil ion from 2018-19 to 2021-22,

including an increase in revenue of about $3.7 bil ion offset by an increase in payments of about

$150 million.

Of the $3.7 bil ion revenue gain, most of the $3.3 billion in 2019-20 arises because of a change in the time

that tobacco excise is paid (ie. shifting the taxing point to the point of importation).

This largely reflects a one-off boost to revenue in the first year of the measure as al stock held in

warehouses as at 1 July 2019 becomes liable for duty and, at the same time, revenue is received from new

tobacco imports due to the earlier taxing point.

5. What is the tobacco Tax Gap? How does it compare with the budget

estimates?

The 2015-16 net Tax Gap for tobacco was $594 mil ion.

The Treasury costing and the tax gap estimate vary as they measure different things.

The ATO tax gap estimate is a theoretical estimate of how much revenue would be raised if all illegal tobacco

were to be taxed in 2015-16. The Budget estimate is what wil happen in the real world as a result of the

policy changes announced by the Government.

A key difference is that tax gap estimates don’t estimate how effective any policy will be at reducing illegal

tobacco. The Budget estimates recognise that the criminal gangs behind il icit tobacco are sophisticated and

well-resourced, and it would be misleading to assume that this package wil shut down the entire il icit

tobacco market overnight.

A second key difference is that tax gap estimates don’t include any behavioural responses, such as reduced

smoking due to significant price increases as il egal tobacco is taken off the market. Nor do they include the

increased enforcement costs of closing the gap.

3

Collecting tobacco duties and taxes at the border

6. What is the previous taxing process?

Previously, tobacco was imported by tobacco companies and stored in bonded warehouses. A bonded

warehouse was one licenced by the ATO to store Excise Equivalent Goods (in this case tobacco) before excise

was paid.

Duty was paid in weekly instalments based on the amount of tobacco that had left the underbond

warehouse system and entered the domestic market.

7. What is warehouse leakage? How does it occur?

Warehouse leakage was the unauthorised or il egal removal of tobacco from a storage warehouse prior to

the payment of applicable taxes such as excise.

According to DHA and ATO estimates, approximately 250 tonnes of tobacco in licensed warehouses was

unaccounted for in 2015-16, and around $172 mil ion of tobacco duty was lost through leakage from the

warehouse system.

Conducting compliance activity to combat this behaviour was extremely difficult as large volumes of tobacco

was transferred between networks of licensed warehouses, obscuring the gap between the volume of

tobacco on which tax had been paid and the volume that was imported. Criminal gangs were suspected of

exploiting these weaknesses to steal tobacco.

Moving the taxing point to when the tobacco enters the country and imposing a permit system should stem

this leakage. This puts the onus on the tobacco importers to ensure that the tobacco is secure as tax has

already been paid. Any loss of tobacco effectively becomes a loss to the importer.

8. Is this a new tax on tobacco? Will this affect the price of tobacco?

No. This measure does not increase the amount of tobacco duty that importers must pay. It moved the tax

point from when tobacco enters the domestic market for consumption to when it enters the country. This

will prevent leakage of illicit tobacco from warehouses.

Prices may increase separately in line with standard six monthly changes to tobacco excise and already

legislated tobacco excise increases on 1 September 2020.

9. How will this impact the cash flow of tobacco importers?

Importers are now required to pay tobacco duties at the point of importation, earlier than under the current

system and in advance of the point of sale.

The measure has a one-off impact on importers as tobacco held in warehouses as at 1 July 2019 will be liable

for tax at that time rather than when it enters the domestic market.

There were four broad options to enable tobacco companies to meet their excise liabilities as at 1 July 2019:

1. Reduce the likely inventory outstanding, by not replacing existing stock in warehouses as it was

sold, or for aged stock that is at risk of being unsaleable, applying to have it securely destroyed.

2. Start paying duties on imports prior to 1 July 2019, to smooth the cash flow impact across the

financial years.

4

3. Import produce closer to when it is required by customers (‘just in time’), such as by importing

smaller quantities or staggering deliveries, and holding stock in countries closer to Australia until

needed by a customer.

4. Participate in the transitional arrangements.

To smooth the transitional impact on cash-flow, tobacco importers who are eligible to participate in the

transitional arrangements are able to pay the outstanding duties in 12 equal instalments over 12 months to

Home Affairs, on the basis they have provided an up-front financial security, and make the final payment by

30 June 2020.

The size of the security was determined based on a risk assessment made by the ATO and DHA, and ranges

from 25 per cent for smal importers to 100 per cent. For smal tobacco importers, the security was capped

at up to 25 per cent of the liability outstanding on the stock on hand at 30 June 2019, as part of negotiations

with Senators to secure the passage of the relevant legislation.

Al tobacco importers participating in the transitional arrangements had to make sure their income tax, GST

and customs returns and remittances were up to date by 1 June 2019.

10. How did the Government prevent duty evasion ahead of the change in tax

point?

The ATO and Australian Border Force conducted stocktakes and reconciled warehoused tobacco prior to

1 July 2019. This ensured an accurate calculation of tax and duty liability for warehoused stock as at 30 June

2019.

The ATO also cancelled permissions for the movement of warehoused tobacco for some warehouses prior to

1 July 2019 to ensure the integrity of the stocktakes. (Movement permissions allowed importers to move

tobacco between warehouses without incurring a duty liability.)

11. What impact will this have on the underbond warehousing industry?

As tobacco is a perishable product and has a limited shelf-life, tobacco importers wil need to continue to

import tobacco and have sufficient stock at hand, in warehouses, in order to meet ongoing demand.

The package means less red-tape for warehouses because duty wil already have been paid and so they wil

no longer be subject to duty control measures.

There have only been a smal number of complaints from the warehousing industry, mostly in relation to the

measures’ negative effect on cash-flow, which we are addressing through transitional arrangements.

12. What consultation was undertaken with the industry?

The Government undertook public consultations from 8 August to 22 August 2018 on the Treasury and the

Home Affairs’ complementary exposure draft legislation. Consultation was conducted jointly between

Treasury and Home Affairs.

Eleven submissions were received. The tobacco industry is broadly supportive. Some submissions raised

concerns about the cash flow impact, which are being addressed through the transitional arrangements.

The non-confidential submissions have been published on the Treasury website.

5

The Taskforce and Permits System

13. How does the permit system work?

Since 1 July 2019, al importers have been required to hold a permit to import tobacco. Importers can apply

for a permit through the Department of Home Affairs. As processing applications may take some time, DHA

has some flexibility to administer the system during the transitional period.

Permits are valid for set periods with importers required to renew their permits periodically. This allows

enforcement agencies to ensure that importers are complying with their obligations under the permit

system. A comprehensive consultation and communication campaign has been conducted to notify

importers of the changes and their obligations.

14. What are the Illicit Tobacco Task Force’s capabilities and powers?

There are three components to the Il icit Tobacco Task Force:

Intel igence: systems analysis and targeting organised crime syndicates to provide accurate

information to operational teams.

Enforcement: operational teams to detect and seize il icit tobacco at the border and investigate

organised crime using a coordinated multi-agency approach to disrupt supply chains.

Prosecution: the new offences enacted in August 2018 provide the task force with greater ability to

prosecute il egal activity by establishing reasonable suspicion offenses and removing the

requirement to prove origin.

15. What is the impact on tobacconists, duty free stores and other small

retailers/consumers?

Approximately 97 per cent of tobacco entering Australia reflects three main importers.

Most tobacconists and other smal -scale retailers and consumers are not affected because they purchase

tobacco from another importer rather than importing tobacco directly. If they import the tobacco

themselves, they are required to have a permit and pay the duty when the tobacco enters the country.

Duty free stores, providores and catering bonds (entities which store goods to be supplied to international

aircrafts or ships) are exempt from the change in tax point. The importers who supply these stores are able

to claim a refund of the duty that was paid at the border.

Consistent with existing arrangements, where travellers are found with tobacco at the border above the

duty-free threshold (25 cigarettes), they are given the option of paying the duty at the border or forfeiting

the tobacco.

16. What is the Government doing to address the delays in refunds and

drawbacks for tobacco under the new arrangements?

Since 1 July 2019, one major tobacco importer has raised with Home Affairs that it takes too long to receive

a refund of duty paid under the new arrangements for tobacco that is provided to duty free stores or re-

exported.

6

Home Affairs advises that al importers are encouraged to utilise a licensed customs broker on their behalf as

a way to facilitate smoother and more efficient processing of refund and drawback claims. Home Affairs wil

only consider a refund or drawback claim once al relevant information has been provided.

Background

17. Overview of the tobacco importing industry.

Since 1 July 2019, al tobacco imports are taxed at the border.

There were previously only 37 importers of tobacco who stored tobacco under bond in licenced warehouses

(before tobacco is entered for home consumption). The largest 3 importers accounted for approximately

97 per cent of al imports.

There are approximately 1000 other smal importers who previously paid at the border.

18. What are the different tobacco types?

There are three main types of tobacco consumed in Australia:

Cigarettes/cigars: Cigarettes are the most common form of tobacco consumed in Australia.

Rol Your Own (RYO): Loose leaf tobacco, which people rol into cigarettes using cigarette papers. It

is cheaper than buying retail cigarettes.

Molasses (shisha): Molasses tobacco, also known as shisha tobacco, is a syrupy tobacco mix with

flavours added to it. It is commonly smoked through a water pipe and can have a tobacco content of

anywhere from 30 per cent to 70 per cent.

Other types of tobacco, which are not currently legal in Australia include:

Electronic devices (E-cigarettes): Products that heat ‘e-liquids’ to form an aerosol, which is then

inhaled by the user. E-liquids containing nicotine are illegal and not for sale in Australia.

Smokeless tobacco (snuff or snus): Smokeless tobacco product placed under the lip. It is currently

not legal in Australia after being outlawed in 1991.

Chewing tobacco: A smokeless tobacco product which is chewed. It is currently not legal in Australia.

19. How much revenue is raised through tobacco duty?

At the 2019-20 Budget, tobacco receipts for 2019-20 are forecast to be $17,410 billion, reflecting the

commencement of the 2018-19 Budget measure

Black Economy Package — combatting illicit tobacco, which

included the shift in the taxing point to the border. The Final Budget Outcome for tobacco receipts for 2018-

19 was $12,147m.

20. What are the current excise rates for tobacco?

• Tobacco in stick form not exceeding 0.8 grams (e.g. cigarettes): $0.93653 per stick

• Other tobacco (e.g. loose leaf tobacco): $1291.77 per kilogram

Tobacco excise rates are indexed to Average Weekly Ordinary Time Earnings. The increases occur on

1 March and 1 September each year.

7

Tobacco excise rates increased by 12.5 per cent on 1 September 2029 and wil increase by an additional

12.5 per cent on 1 September 2020. This reflects the decision taken in the 2016-17 Budget to increase excise

rates each year from 2017 to 2020.

The per kilogram rate is being adjusted over four years, from 2017 to 2020, to align the tax treatment of rol

your own tobacco and cigarettes. These adjustments occur on 1 September each year.

March Sept

March Sept

March Sept

March Sept

March Sept

2012

2012

2013

2013

2014

2014

2015

2015

2016

2016

Indexation

1.006 1.016 1.008 1.137

1.139 1.016 1.13

1.012 1.136

(AWOTE)

Legislated

12.5%*

12.5%

12.5%

12.5%

Excise per 433.53 436.13 443.11 446.65 508.01 578.37 587.62 663.70 671.68 763.20

kilogram($)

Excise per 0.34681 0.34889 0.35447 0.35731 0.40639 0.46268 0.47008 0.53096 0.53733 0.61054

stick($)

*December 2013

March Sept

March Sept

March Sept

March Sept

March Sept

2017

2017

2018

2018

2019

2019

2020

2020

2021

2021

Indexation 1.011

1.132 1.017 1.010 AWOTE AWOTE AWOTE AWOTE AWOTE AWOTE

(AWOTE)

Legislated

12.5%

12.5%

12.5%

12.5%

Excise per 771.60 901.39 916.72 1,076.35 1,090.33 1291.77

kilogram($)

Excise per 0.61726 0.69858 0.71046 0.80726 0.81775 0.93653

stick($)

21. How is the 12.5 per cent applied?

The 12.5 per cent is applied at the same time as AWOTE (1 September each year to 2020). It doesn’t matter

which is applied first as it’s multiplicative.

22. What is the price of a pack of cigarettes, and how much is excise?

Product

Recommended

Excise rate (per

Current duty

retail price

stick)

component

GST

Total tax

Example mid-

$37.00

0.93653

$23.41

$3.36

$26.77

range

(pack of 25)

23. Is the illicit tobacco market a result of higher excise rates?

According to the World Health Organisation increasing tobacco duty is among the most effective

interventions to reduce the prevalence of smoking. Some criminals have chosen to break the law and not

pay duty. The Government is continuing to take action to address this criminal behaviour.

The exact amount that the il icit tobacco market can be expected to grow due to an increase in excise rates

cannot be accurately measured because the illicit market is driven by a multitude of factors of which the

duty rate is only one.

24. Reasons for tobacco excise (and are our tobacco taxes too high?)

There have been significant efforts by governments in recent years to reduce tobacco consumption through

a comprehensive suite of tobacco control measures, including staged increases and a swap to wage

indexation for tobacco excise.

The taxation of tobacco products helps to pay for essential services such as the delivery of health services

and other areas of spending that benefit the whole Australian community.

8

The World Health Organisation (WHO) identifies price increases through taxation as one of the most

effective ways governments can reduce tobacco consumption. Australia is a signatory to the WHO

Framework Convention on Tobacco Control, a treaty to address the health, social, environmental and

economic consequences of tobacco consumption and exposure to tobacco smoke worldwide.

Australia’s tobacco tax rates are nearing the World Health Organisation’s recommended level, which

recommends that duty should account for 70 per cent of the retail price of tobacco products.

Excise increases announced in the 2016-17 Budget wil improve the health of Australians by reducing their

exposure to tobacco products and move Australia closer to the World Health Organization’s recommended

level of tobacco excise.

As of 1 September 2019, tobacco duty was estimated to account for between 60 and 71 per cent of the retail

price of four popular brands of manufactured cigarettes sold in Australia.

25. Who has jurisdiction for combatting illicit tobacco?

The Department of Home Affairs is responsible for combatting tobacco smuggling, such as attempts to

import tobacco using cargo containers or the international mail without paying customs duty.

The ATO is responsible for combatting il icit domestic tobacco crops.

The way both agencies address il icit tobacco at the retail level is by attempting to cut-off illicit tobacco at

the source (domestic crops and smuggling).

State and Territory police forces provide intelligence and protection for ATO and Border Force officers

conducting raids on illicit domestic tobacco crops or shipments.

Under the new Il icit Tobacco Task Force, the ATO, the Department of Home Affairs and the New South

Wales and Victorian Police Forces, as well as a number of other enforcement agencies, work together as part

of a single taskforce to combat tobacco smuggling.

The additional funding for the ATO provides additional investigators to detect and destroy illicit tobacco

crops and conduct fol ow-up criminal investigation activity. These activities will continue to be conducted in

partnership with local police forces.

26. What are the new offences in the Illicit Tobacco Offences legislation?

The Government increased offences for illicit tobacco in August 2018.

The new offences include penalties for reasonable suspicion offences (see table below), where it is

reasonable to assume that duty has not been paid on the tobacco. This makes it easier for the Illicit Tobacco

Taskforce and the ATO to prosecute offenders in instances where more than 5kgs of il icit tobacco is found

but it is difficult to prove intent.

A civil penalty has also been introduced for the possession of more than 2kgs of tobacco where there is a

lack of documentary evidence to justify the possession of the tobacco. The penalty is a fine of up to $21,000.

The customs amendments make it an offence to import tobacco where a person is reckless as to whether

they are defrauding the revenue. The penalty wil be up to 5 years imprisonment and/or a fine of 3 times the

duty payable or up to $105,000.

9

The law removes the requirement for prosecutors to prove whether the il icit tobacco was grown

domestical y or imported, which made it difficult to take enforcement action.

The penalties for each tiered offence are:

Penalties

Reasonable suspicion

Intentional offences

5kg or more

The greater of:

The greater of:

[Considered a limited • $42,000 fine; or

• $105,000 fine; or

commercial use]

• 5 times duty payable

• 5 times duty payable

100kg or more

2 years imprisonment or

5 years imprisonment or

[Considered a

greater of:

greater of:

marketable quantity] • $105,000 fine; or

• $210,000 fine; or

• 5 times duty payable

• 5 times duty payable

500kg or more

5 years imprisonment or

10 years imprisonment or

[Considered a

greater of:

greater of:

commercial

• $210,000 fine; or

• $315,000 fine; or

quantity]

• 5 times duty payable

• 5 times duty payable

27. Why is the Government not actioning the Black Economy Taskforce

recommendation regarding track-and-trace, as noted in a recent World Bank

report?

The World Bank released the report ‘Confronting Il icit Tobacco Trade – A Global Review of Country

Experiences’ on 23 January 2019. It recognises the significant measures announced by Government to

strengthen both enforcement capabilities and tobacco tax administration fol owing the work of the Black

Economy Taskforce.

A key criticism in the World Bank report ‘Confronting Il icit Tobacco Trade – A Global Review of Country

Experiences’, 23 January 2019 concerns Australia’s lack of track-and-trace. It notes:

“The Black Economy Taskforce offered a number of recommendations that have either been “noted” or

explicitly “disagreed with” by the Government, the most salient being the use of track-and-trace

technology (Treasury 2017: 310-311). Regarding track-and-trace, the Government has opted for a wait-

and-see approach, preferring to review at a later date the success or otherwise of the other control

measures…”(Treasury 2018: 35).”

It is expected that the 2017-18 and 2018-19 Budget measures will have a significant impact on the illicit

tobacco market in Australia and the Government wil assess the impact of these measures before

determining whether Australia should adopt track and trace and become a Party to the Protocol.

Most countries do not currently use a track-and-trace approach. Two countries that have adopted track-and-

trace in recent years include Brazil, which began operating a track-and-trace system in 2008, and Ecuador,

which implemented track-and trace for domestical y produced cigarettes in 2017. In addition to these

countries, EU member states are poised to introduce an EU-wide tracking and tracing system by May 2019.

28. Potential registration of tobacco license holders on a public register

The major tobacco importers have also suggested a register of permit holders be published to assist retailers

in identifying suppliers of illicit tobacco.

Treasury and Home Affairs is concerned about privacy issues for tobacco permit holders who may wish not

to be publicly identified.

10

As with track and trace, Home Affairs and Treasury consider the Government should monitor the impact of

the illicit tobacco package before considering further measures.

29. KPMG ‘Illicit Tobacco in Australia’ Report 2018

KPMG’s Illicit Tobacco in Australia Report, commissioned by Philip Morris and Imperial Tobacco, estimates

that illicit tobacco cost the Government $2.02 billion in forgone revenue in 2018.

• The KPMG estimate of forgone revenue is significantly larger than the Australian Taxation Office

(ATO) and Department of Home Affairs (DHA) tax gap research, which estimated illicit tobacco

represented around $600 million of forgone revenue in 2015-16. An explanation of the differences

between these estimates is at Additional Information.

KPMG also found that consumption of il icit tobacco declined by 11.1 per cent between 2017 and 2018. As a

proportion of al tobacco consumption, consumption of illicit tobacco fell from 15.0 per cent in 2017 to 14.1

per cent in 2018.

Contraband accounted for 53.7 per cent of il icit tobacco consumption. Contraband refers to cigarettes

manufactured legal y outside of Australia and smuggled into the country.

KPMG’s estimates differ from the tax gap analysis prepared by the ATO and Home Affairs, in part because

they measure different things and use different methodologies.

• The KPMG methodology primarily uses a consumption model based on a consumer survey; and an

empty pack survey analysis. The ATO and Home Affairs methodology uses a supply side model.

Some aspects of the KPMG methodology are considered to be prone to variance including

• The use of empty packet analysis, as it is impossible to estimate and adjust for legitimate overseas

imports and the duty free al owance for international air passengers.

• Surveys suffer from misinterpretation and error.

• A change in the methodology through a new panel of respondents.

The estimates by the ATO and Home Affairs are based on extensive and high quality data held by these

agencies, and use a methodology endorsed by independent experts.

30. Why is the Government not actioning the Black Economy Taskforce

recommendation to reduce taxes and duties on molasses tobacco (shisha)?

Molasses tobacco, also known as shisha tobacco, is a syrupy tobacco mix with flavours added to it. It is

commonly smoked through a water pipe and can have a tobacco content of anywhere from 30 per cent to

70 per cent.

The addition of flavours and water to the tobacco leaves makes it difficult to determine the actual tobacco

content of molasses tobacco without special scientific instruments.

Reflecting this, changes were made in 2008 so that molasses tobacco was taxed on its total weight, not just

its tobacco content. This made it significantly easier for Border Force personnel to determine the duty

payable on the tobacco.

Reversing that change would be a significant impost on the Border Force and would divert resources from

higher risk border security activities such as stopping il icit drugs and guns.

11

The additional resources dedicated to combating tobacco smuggling and the introduction of the new permit

system will address illicit shisha tobacco imports.

s 22

12

FOI 3812

Document 4

FOR OFFICIAL USE ONLY

How else is the Government combating illicit tobacco?

In the 2016-17 Budget the Government provided an extra $7.7 mil ion of funding for

the Tobacco Strike Team.

The tobacco strike team has seized 400 tonnes of il icit tobacco with an estimated

dutiable value of around $300 mil ion.

What has been done to combat illicit tobacco prior to the introduction of this

legislation?

The ATO has undertaken 16 investigations since 1 July 2016 resulting in the seizure

and destruction of almost 120 tonnes of il icit tobacco, with an estimated duty

forgone of over $91 mil ion. Since 1 July 2011 the ATO has conducted 26

investigations seized il icit tobacco with an estimated duty forgone of $160 mil ion.

The ATO focuses on domestic growing and production and due to constraints with

the current law (the proof of origin concept) is limited to being able to seize il icit

tobacco and prosecute people caught growing it.

Are our tobacco taxes too high?

Australia taxes tobacco below the World Health Organisation’s recommended level

of tobacco excise, which is that excise should account for 70 per cent of the retail

price of tobacco products.

As of 1 September 2017, tobacco excise was estimated to account for between 53

and 62 per cent of the retail price of five popular brands of manufactured cigarettes

sold in Australia.

As part of the 2016-17 Budget, the Government announced four annual 12.5 per

cent tobacco excise increases, beginning 1 September 2017. These increases wil

bring Australia closer to meeting the World Health Organisation’s target.

–

The excise increases are in addition to the biannual indexation to average

weekly ordinary time earnings.

s 22

FOR OFFICIAL USE ONLY

s 22

Has increasing the excise rate resulted in more illicit tobacco?

Treasury has not estimated how much revenue has been lost due to the

consumption of il icit tobacco in Australia.

Background: The 2017 KPMG

Report into Il icit Tobacco estimated that $1.61 bil ion

more in revenue would have been received in 2016 if all il icit tobacco consumption

had been legal consumption. Philip Morris Ltd and Imperial Tobacco Australia Ltd

commissioned the report.

Given government has increased the taxation of tobacco, what is the

government doing to combat illicit tobacco?

The Government has established a Black Economy Taskforce to develop a forward-

looking whole-of-government strategy to combat the black economy.

–

A Final Report is being considered now.

In the 2016-17 Budget, the Government announced an additional $7.7 mil ion in

funding to expand the Tobacco Strike Team, and reforms to the

Customs Act 1901

and

Excise Act 1901 to provide enforcement officers with access to tiered offences.

–

The expansion of the Tobacco Strike Team has taken place, and

legislation to implement tiered offences continues to be progressed.

–

Since October 2015, the Australian Border Force has stopped more than

400 tonnes of il icit tobacco (valued at $294 mil ion) from reaching the black market.

Refer questions on the Tobacco Strike Team to DEPT OF HOME AFFAIRS.

Who is responsible for stopping illicit tobacco?

The Commonwealth and the States and Territories share responsibility for il icit

tobacco.

Commonwealth departments including the Australian Federal Police, Australian

Border Force, the ATO, the Australian Crime Commission and the Australian

Transaction Reports and Analysis Centre (AUSTRAC) work with State and Territory

police to combat il icit tobacco importation and cultivation.

Treasury is responsible for setting excise taxation rates. Treasury does not engage

in enforcement activities.

FOR OFFICIAL USE ONLY

FOR OFFICIAL USE ONLY

The ATO is responsible for detecting, investigating and prosecuting il icit

domestically grown or manufactured tobacco products. The ATO is also responsible

for ensuring that businesses, such as tobacco retailers, are correctly declaring

income and sales for income tax purposes and GST reporting.

–

Where crops are identified the ATO takes action to disrupt those

operations, however most il icit product is thought to be imported. Refer

further questions on combatting domestically grown il icit tobacco to the

ATO.

–

Background: Since 2006 no-one has been licensed to grow tobacco in

Australia.

Department of Home Af airs is responsible for preventing il icit tobacco from being

imported into Australia and collecting customs duties and taxes on imported tobacco

products.

If asked about illicit tobacco in the retail environment

The Department of Home Af airs and the ATO focus their resources on cutting off the

imported and domestic supply of il icit tobacco at the source as opposed to individual

retail outlets.

s 22

FOR OFFICIAL USE ONLY

FOI 3812

Document 11

Talking points from the 2023-24 Budget changes to Aligning the treatment of stick and non-stick

tobacco tax and increasing tobacco tax

•

The Government is taking steps to reduce smoking and nicotine use and address the physical

and social harms it causes.

•

These changes are part of the Government’s response to the National Tobacco Strategy and

related initiatives on vaping and smoking prevention and cessation, and an enhanced

regulatory approach to vaping.

–

The Government announced a range of health measures in the 2023-24 Budget targeted

at tobacco and vape use. These include;

:

increased funding for smoking and vaping cessation services, expanded the

Tackling Indigenous Smoking Program, and established national public health

campaigns to prevent uptake and reduce smoking and vaping.

:

The Government is also providing ongoing funding to establish and maintain a new

national lung cancer screening program. The program will support the early

detection of lung cancer in high-risk individuals.

•

The tax changes to tobacco complement the National Tobacco Strategy and involve:

–

increasing the tax on tobacco by 5 per cent per year for 3 years from 1 September 2023,

in addition to the normal indexation of tobacco excise; and

–

aligning the tax treatment of loose-leaf tobacco products (such as roll-your-own tobacco)

with the manufactured stick excise rate to ensure loose-leaf tobacco is taxed equally.

•

The first of the 5 per cent increases to tobacco excise has taken effect from 1 September 2023.

Tobacco Use

•

Tobacco use remains the leading cause of preventable death and disability in Australia and was

estimated to be the cause of death of over 20,000 Australians in 2018.

–

In 2021-22, 10.1 per cent of people aged 18 plus in the general population (2 million

Australians) reported daily smoking.

•

Statistics from the National Health Survey, last released in 2018, indicate that since 1995, the

proportion of adults who are daily smokers has decreased from 23.8 per cent to 13.8 per cent

in 2017-18.

•

The National Tobacco Strategy 2023-2030 aims to achieve a national daily smoking prevalence

of less than 10 per cent by 2025 and 5 per cent or less by 2030 in Australia, and to reduce the

daily smoking rate among First Nations people to 27 per cent or less by 2030.

Risks and Sensitivities

Illicit tobacco risks

•

Further increases to the tobacco excise and excise-equivalent customs duty will, however,

strengthen incentives to trade in illicit tobacco, both counterfeit cigarettes and loose-leaf

tobacco, as well as substitution into electronic cigarettes (“vapes”) containing nicotine, which

are substantially cheaper than even illicit cigarettes.

s 22

Demographic impacts

•

The package of health measures in the budget will provide support on prevention, cessation

and health care:

–

Some programs are targeted at socially disadvantaged groups such as the Aboriginal and

Torres Strait Islander Cancer Plan and First Nations Cancer Package.

–

The Government is also providing ongoing funding to establish and maintain a new

national lung cancer screening program. The program will support the early detection of

lung cancer in high-risk individuals and the screening program will target older

Australians with a history of heavy smoking.

•

Tobacco tax changes, viewed in isolation, can disproportionately impact socially disadvantaged

groups, who are more likely to be regular smokers, and suffer corresponding health impacts.

These include:

–

First Nations Peoples – according to the Australian Bureau of Statistics’ 2019 National

Aboriginal and Torres Strait Islander Health Survey, around 41 per cent of First Nations

peoples aged 15 or over were current smokers in 2018-19, which is substantially higher

than the general population

–

lower socio-economic and labour force status groups

–

adults living in areas of most disadvantage

–

adults living in outer regional and remote Australia

–

persons with a highest level of educational attainment of Year 10 or below

–

people aged 50-59; and

–

people with mental health conditions and high psychological distress.

•

However, socially disadvantaged groups are also those that are more likely to quit smoking in

response to increases in prices.

Question and Answers

How do these changes tie in with the National Tobacco Strategy 2023-2030 and the excise changes

announced in the 2023-24 Budget?

Australian Government policy has long reflected that tobacco smoking in all its forms is dangerous.

The National Tobacco Strategy outlines a national policy framework for government and non-

government organisations to work together to improve the health of all Australians by reducing

smoking rates.

The annual 5 per cent increase to the tax on tobacco supports the National Tobacco Strategy priority

of strengthening regulation to reduce the supply, availability, and accessibility of tobacco products.

The better alignment of the tax treatment of loose-leaf tobacco products with the manufactured

stick excise and excise equivalent customs duty will help to ensure these products are taxed equally.

What is the Government doing to reduce smoking and vaping

The Albanese Government is taking strong action to reduce smoking and stamp out vaping –

particularly among young Australians – through stronger legislation, enforcement, education and

support.

The 2023–24 Budget includes $737 million to fund a number of measures to protect Australians

against the harm caused by tobacco and vaping products.

These measures complement the development of new proposed national tobacco control legislation

first announced by the Government in November 2022.

OFFICIAL

FOI 3812

Document 12

Tobacco taxes & il icit tobacco – Additional Points

s 22

2. Does Treasury think high tobacco taxes are driving illicit tobacco in Australia?

• The illicit market is driven by a multitude of factors, of which the excise rate is only one.

• Tobacco use remains the leading cause of preventable death and disability in Australia.

o Reducing the affordability of tobacco products through taxation increases remains

the most effective measure in reducing smoking rates.

• The decision to take further action on illicit tobacco is a matter for government.

3. Does Treasury think tobacco taxes are now too high?

• Tobacco use remains the leading cause of preventable death and disability in Australia.

• Reducing the affordability of tobacco products through taxation increases remains the most

effective measure in reducing smoking rates.

• The increasing tobacco excise has a very clear basis — the best deterrent for consumer

demand is price.

o The World Health Organisation (WHO) recognises this as the most effective

intervention that governments can make. As such, tobacco taxation remains a

central component of Australia’s tobacco control response.

OFFICIAL

FOI 3812

Document 14

s 22

For the first time, the latest Intergenerational Report (IGR) modelled a decline in indirect taxes over

the coming 40 years, driven partly by declines in tobacco excise (see IGR Box 8.1). As tobacco excise is

one of the largest sources of indirect tax, declines in smoking rates have implications for the

sustainability of the tax base. This week’s chart highlights the uncertainty of the outlook for tobacco

excise receipts over the IGR period.

s 22

The IGR baseline modelling of tobacco (blue line) assumes that the quantity of tobacco products

imported, or clearances, will remain constant over the long run. This is consistent with the approach

taken for the medium-term tobacco projections and represents a decline in per capita consumption

of legal tobacco as the population grows. Tobacco collections are projected to decline from 0.5 per

cent of GDP in 2022-23 to less than 0.4 per cent of GDP in 2062-63 in this baseline. However, this

somewhat simplified assumption does not factor in the impact of future policy change (which has

likely had a significant impact on smoking rates in the past), future changes in preferences, the rise of

vaping, or the growing illicit market – all of which are very difficult to project.

To demonstrate the potential revenue impact of a faster decline in tobacco consumption, we

examined the National Health Survey data collected by the Australian Bureau of Statistics on changes

in numbers of daily smokers by age and sex from 2011-12 to 2020-21. We compared corresponding

cohorts (e.g., 25-34 year old males in 2011-12 with 35-44 year old males in 2020-21), and found

significant falls in smoking rates for all cohorts. Assuming rates of smoking would continue to decline

at the same rate over the IGR projection period, excise receipts would decline to less than 0.1 per cent

of GDP by the end of the IGR period (red line).

s 22

Tax Analysis Division

20 October 2023

1

FOI 3812

OFFICIAL

Document 15

BACKPOCKET – Tobacco excise receipts, clearances, and forecasts

Senate Estimates briefing – October 2024

Key Points

Policy context

•

The Government is committed to reduce smoking related harms in Australia:

–

Tobacco use remains the leading cause of preventable death and disability in Australia.

–

Reducing the affordability of tobacco products through taxation increases remains the

most effective measure in reducing smoking rates.

•

As part of the 2023-24 Budget, the Government announced further increases to tobacco

excise (and excise-equivalent customs duty) of 5 per cent a year for 3 years, from 1 September

2023 to 1 September 2025.

–

The Government is also progressively lowering the equalisation weight for loose-leaf

tobacco from 0.7 grams to 0.6 grams per stick in annual increments from 1 September

2024 to 1 September 2026.

s 22

•

The increasing tobacco excise has a very clear basis — the best deterrent for consumer

demand is price.

–

The World Health Organisation (WHO) recognises this as the most effective intervention

that governments can make. As such, tobacco taxation remains a central component of

Australia’s tobacco control response.

s 22

PROTECTED

PROTECTED

•

The illicit market is driven by a multitude of factors of which the excise rate is only one.

s 22

PROTECTED

PROTECTED

• While clearances have been in a long-term decline, the steep decline in 2023-24 is being

driven by a combination of factors, including:

–

increased substitution to the illicit market, which is partly driven by higher excise

rates,

–

higher rates of quitting, and

–

weaker growth in discretionary spending due to cost-of-living pressures also

affecting tobacco consumption.

s 22

PROTECTED

PROTECTED

s 22

Impact of the 2023-24 Budget measure on tobacco receipts

• In the 2023-24 Budget, the Government increased tobacco excise by 5 per cent per year

for three years from 1 September 2023, in addition to normal indexation. The

Government also aligned the tax treatment of tobacco products subject to the per

kilogram excise rate with the per-stick rate, by progressively lowering the ‘equalisation

weight’ from 0.7 to 0.6 grams over four years, starting on 1 September 2023 and

reaching 0.6 grams on 1 September 2026.

s 22

• It is not possible to split out the impact of the 2023-24 Budget measure on the decline in

tobacco tax receipts, but the drivers would include:

–

Increased substitution to the illicit market

–

Higher rates of quitting

–

Continued weaker growth in discretionary spending due to cost-of-living

pressures also affecting tobacco consumption

s 22

PROTECTED

OFFICIAL

FOI 3812

Document 16

Elasticity analysis for tobacco

s 22

OFFICIAL

OFFICIAL

OFFICIAL

Why we estimate and update the elasticity?

• Inclusion of the elasticity in the tobacco costing model

captures behaviour response to rate changes.

• It improves calculation of financial implications of policy

proposals.

OFFICIAL

4

OFFICIAL

OFFICIAL

Elasticity estimation

• The price elasticity used in the current tobacco costing model

– Least squared analysis in excel (1995-2015)

▪ 𝑙𝑛ν𝑡 = 𝛼 + 𝛽 ln 𝑝𝑡 + 𝜀𝑡,

(1)

▪ ν𝑡: volume of tobacco consumed

▪ 𝑝𝑡: relative price (tobacco price/household consumable goods price)

▪ 𝛽: price elasticity

– 𝛽 = −0.5

• Two improvements in this update:

– Model: add income and habits/addiction to the model

– Data: update the dataset

OFFICIAL

6

OFFICIAL

OFFICIAL

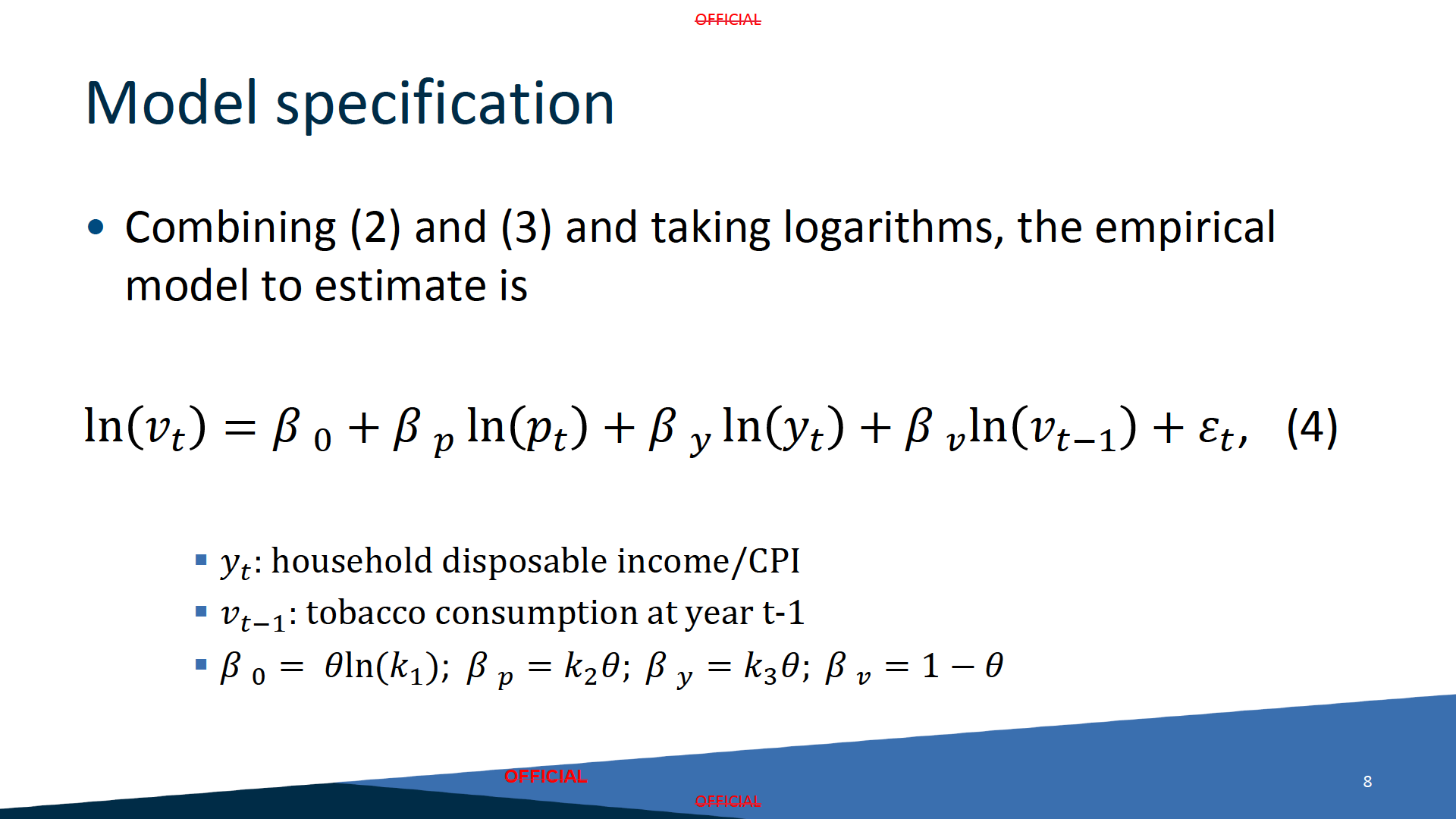

A dynamic demand model for tobacco in Australia

• Desired tobacco consumption

𝑣∗

𝜅 2

𝜅 3

𝑡 = 𝜅 1𝑝𝑡

𝑦𝑡

,

(2)

• Actual tobacco consumption

𝑣

∗

𝑡 = (𝑣𝑡 )𝜃(𝑣𝑡−1)1−𝜃,

(3)

𝜃 = 1, 𝑣

∗ (𝑓𝑢𝑙𝑙 𝑎𝑑𝑗𝑢𝑠𝑡𝑚𝑒𝑛𝑡)

ቊ

𝑡 = 𝑣𝑡

𝜃 = 0, 𝑣𝑡 = 𝑣𝑡−1(𝑧𝑒𝑟𝑜 𝑎𝑑𝑗𝑢𝑠𝑡𝑚𝑒𝑛𝑡)

OFFICIAL

7

OFFICIAL

s 22

FOI 3812

Document 17

s 22

PROTECTED

• These downgrades reflect the following factors:

o Preliminary tobacco receipts to end-October are lower than the 2023-24

financial year by $0.5 billion s 22

o Increased substitution to the illicit market, which is partly driven by higher

excise rates,

o increased substitution to vaping,

o higher rates of quitting, and

o the effect of weaker growth in discretionary spending due to cost-of-living

pressures on tobacco consumption.

s 22

PROTECTED

PROTECTED

Additional information

Illicit tobacco

• A contributing factor to the decline in legal tobacco consumption is the large

difference in price between legal and illicit products.

o Illicit tobacco products are sold at a considerably lower price compared to

legal tobacco (around $15 cheaper for a standard 20s cigarette pack).

s 22

s 22

PROTECTED

FOI 3812

Document 18

Smoking, vaping, and tobacco excise

Senate estimates briefing points – June 2024

s 22

s 22

The 23-24 Budget measure and tobacco excise receipts

• It is not possible to split out the impact of the 2023-24 Budget measure on the decline in

tobacco tax receipts, but the drivers could include:

o Increased substitution to the illicit market

o Continued weaker growth in discretionary spending due to cost-of-living pressures

also affecting tobacco consumption

o Higher rates of quitting

s 22

FOI 3812

Document 19

Senate Economics Legislation Committee

ANSWERS TO QUESTIONS ON NOTICE

Treasury Portfolio

Budget Estimates 2023 - 2024

Agency:

Department of the Treasury

Question No:

BET098

Topic:

Vapour Revenue Modelling

Reference:

Written

(13 June 2023)

Senator:

Hollie Hughes

Question:

1. In the lead up to the Budget, it was publicly reported the Treasury was hinting that vaping

may soon be subject to tougher taxes and that the Albanese Government is considering all

options to the issue. Has Treasury ever modelled the potential revenue from taxing vaping

products like we do with alcohol or tobacco?

If No:

2. If Treasury has never modelled potential revenue from regulating vaping products like

tobacco or alcohol, the Australian Government never really did have all options on the table

to fix this crisis.

https://www.news.com.au/national/nsw-act/politics/treasurer-jim-chalmers-slams-vaping-

explosion/news-story/507143527e513d1f552688ab4ec305eb

3. I refer to Table 5.7 general government receipts in on Page 185 of Budget Paper 1. In

relation to the projected $55.2 billion of tobacco excise revenue over forwards – what impact

or assumptions with regards to Australia’s vaping rate have been factored into this

calculation?

4. The Federal Health Minister has publicly stated – and I quote – “young people who vape

are three times as likely to take up smoking” – as part of the modelling undertaken by

Treasury, is the Australian Government banking on more youth smoking to underpin tobacco

excise?

5. (If no or it hasn’t been taken into account) – So to confirm, while the Health Minister states

those vaping are three times more likely to smoke this assumption hasn’t been included

within the modelling projections – is this because the Health Minister’s statement is not

reliable or statistically significant?

https://budget.gov.au/content/bp1/download/bp1_2023-24.pdf

https://www.health.gov.au/ministers/the-hon-mark-butler-mp/media/taking-action-on-

smoking-and-vaping?language=en

6. With reference to tobacco excise government receipts – after the recent vaping crackdown

announcement from the Australian Government Professor Ron Borland the Deputy Director

of the Melbourne Centre for Behaviour Change at the University of Melbourne publicly

stated – and I quote – “I think there is a high likelihood it will result in an increase in the rates

of tobacco smoking, even though it will achieve its proximal goal of reducing levels of

vaping in the community,”.

SQ23-000357

2

7. Has this ‘high likelihood’ of increased rates of smoking been factored into the forward

estimates for excise revenue?

8. Has nothing been factored into the tobacco excise modelling because Treasury doesn’t

have confidence the announced vaping crackdown will work?

9. Does Treasury view there is a substitution factor between tobacco products and nicotine

vaping products?

10. (If there is a substitution factor or increased smoking has been factored in) – To confirm,

a key beneficiary of the Australian Government’s recently announced vaping policy will be

Treasury through increased tobacco excise receipts?

Answer:

1. Treasury provided a range of advice and analysis to support the development of various

health initiatives in the Budget.

2. Please refer to response for question 1.

3. Tobacco excise is modelled using a ‘base-plus-growth’ approach, where the latest known

outcomes are forecast to grow according to economic parameters. While we don’t explicitly

estimate the impact of vaping, the effects of vaping on tobacco excise are accounted for in the

baseline and historical data.

For more information see Treasury Working Paper 2019-03,

Tobacco excise: historical

trends and forecasting methodology

https://treasury.gov.au/sites/default/files/2019-

07/t392185_tp_tobacco_forecasting_working_paper.pdf.

4. Please refer to response for question 3.

5. Confirmation of the modelling methodology is supplied in response to question 3.

6. N/A

7. See responses to question 3 and question 9.

8. Treasury takes all government policy into account when forecasting revenue.

9. Any substitution impacts are currently implicitly accounted for in the ‘base-plus-growth’

modelling approach (see response to question 3). Treasury regularly examines the data and

evidence available to support its revenue forecast.

10. Please see earlier responses. Substitution between vaping and smoking is not explicitly

accounted for when modelling tobacco excise, however, the effects of vaping on tobacco

excise are accounted for in the baseline and historical data. Tobacco excise is collected by the

Department of Home Affairs and not Treasury.