FOI reference: FOI 25-0092 LD

CR

Right To Know

By email: xxxxxxxxxxxxxxxxxxxxxxxxxx@xxxxxxxxxxx.xxx.xx

Dear CR

Decision on your Freedom of Information Request

I refer to your information access request of 5 November 2024 made to the Department

of Health and Aged Care (the department) under the

Freedom of Information Act 1982

(Cth) (FOI Act). In your request, you sought access to:

1. All notices of a charge issued to FOI applicants between 1 July 2022 and 5 November 2024, specifically:

a. That the applicant is liable to pay a charge, the preliminary assessment of the charge and the

basis for the calculation (FOI Guidelines [4.54a-b]),

b. (if applicable) Any written explanation or justification as to whether the cost of calculating

and collecting the charge might exceed the cost to the agency or the Commonwealth (FOI

Guidelines [4.114(1)] and [4.4]), and

c. The FOI reference number and date of the letter.

2. All notices of a charge decision issued to FOI applicants between 1 July 2022 and 5 November 2024,

specifically:

a. The decision to impose, reduce or waive a charge, as well as the charge amount,

b. (if applicable) Any written explanation or justification as to whether the cost of calculating

and collecting the charge might exceed the cost to the agency or the Commonwealth (FOI

Guidelines [4.114(1)] and [4.4]), and

c. The FOI reference number and date of the letter.

d. Charge decisions made under section 55G of the FOI Act are also included.

3. Any internal review decision letters regarding a charge notice or charge decision between 1 July 2022

and 5 November 2024, specifically:

a. The decision to impose, reduce or waive a charge, as well as the charge amount,

GPO Box 9848 Canberra ACT 2601

- www.health.gov.au

- 2 -

b. (if applicable) Any written explanation or justification as to whether the cost of calculating

and collecting the charge might exceed the cost to the agency or the Commonwealth (FOI

Guidelines [4.114(1)] and [4.4]), and

c. The FOI reference number and date of the letter.

4. Any external review decisions regarding a charge notice or charge decision between 1 July 2022 and 5

November 2024. This includes decisions not to undertake an IC Review.

5. All confirmations of payment and refunds between 1 July 2022 and 5 November 2024. Any document

confirming receipt of payment or refund of payment is included in the scope of my request.

If your agency administers FOI requests on behalf of another entity (e.g., a minister or departmental sub-

branch), such requests are included.

I expect the following to be excluded from the request:

I. The scope of requests

II. Applicant contention reasons

III. Decision-maker explanation of reasons (except part 1.b, 2.b and 3.b)

IV. Applicant review reasons

Please also exclude the following:

I. Any details about FOI applicants, including, but not limited to personal information and

supporting evidence of personal circumstances in a financial hardship contention.

II. Any details about a third party, business, or organisation, including but not limited to their

personal information, business information, and commercial affairs.

III. Any information that may require third-party consultation under the FOI Act.

IV. Any details about any individual, including but not limited to APS staff and signatures.

V. Emails that merely attach charges notices or decision letters.

VI. Duplicate documents.

VII. Background information unrelated to charges.

I agree to exclude any documents already provided to me.

I am authorised under subsection 23(1) of the FOI Act to make decisions in relation to

Freedom of Information requests. I am writing to notify you of my decision on your

access request.

Consultation on scope of request

On 5 November 2024, the department acknowledged your request and contacted you

by email on whether documents provided under FOI 25-0035 LD could be excluded.

On 5 November 2024, you agreed to the department excluding these documents if

previously provided. Further to this email on the same day, you provided the

following:

- 3 -

By way of illustration, please find the table created from the information provided by you for

your reference. You can view this image via WeTransfer here: https://we.tl/t-b0JnQGOLUv

(please note this link expires in 7 days.) This table represents the exact level of information I am

requesting.

The only information I am requesting beyond this table is:

1.ii, 2.ii, 3.ii: Any written explanation or justification regarding whether the cost of calculating

and collecting the charge might exceed the cost to the agency or the Commonwealth.

4. Any external review decisions concerning a charge notice or decision.

On 7 November 2024, you emailed the department amending the scope of your request

to add an additional part seeking access to:

6. A document that identifies whether any FOI requests, where a charge notice was issued

between 1 July 2022 and 5 November 2024, were either withdrawn or deemed withdrawn.

To clarify, I am seeking information on whether a request was withdrawn or deemed withdrawn

after a charge notice was issued. This may be demonstrated through:

- Correspondence from your agency confirming the withdrawal or deemed withdrawal

of a request, or

- The applicant's email confirming their withdrawal of the request.

If no confirmation has been provided by your agency or the applicant, and the request was

deemed withdrawn due to non-response to the charge notice, I request that a document be

created under section 17 of the FOI Act, which shows that the request was deemed withdrawn.

This information is likely to exist in your FOI database or case management systems in

electronic form.

To assist with processing, you may omit the rest of the document beyond what is necessary to

show whether the request was withdrawn or deemed withdrawn after a charge notice was issued.

If your agency is willing, I would prefer this information to be provided administratively, such

as in an appendix to the statement of reasons or as a note in a schedule of documents. Please let

me know if you are open to processing this request administratively, and I will confirm the

withdrawal of this part (6) of my request.

On 15 November 2024, you contacted the department via an alternative email

requesting part 4 of your request be removed from the scope, seeking access to:

4. Any external review decisions regarding a charge notice or charge decision between 1 July

2022 and 5 November 2024. This includes decisions not to undertake an IC Review.

On 18 November 2024, we confirmed removal of part 4 of the request, and sought your

clarification if you were seeking access to records processed by other entities (e.g. the

Minister’s office) and on excluding documents provided under FOI request 25-0035

LD.

On 18 November 2024, you confirmed you were seeking any entities the department

reports for under FOI and documents you were provided access to under FOI request

25-0035 LD could be excluded.

- 4 -

Reasonable searches

The department has conducted reasonable searches for documents in scope of your

request. As per the FOI Guidelines [at 3.89], these searches were undertaken with

reference to:

• the subject matter of your request

• the department’s current and past file management systems

• the department’s record management systems

• the individuals within the department with knowledge of the subject matter of

the documents, or who could assist with location of documents

• the age of the documents.

As you agreed to remove documents previously provided under FOI 25-0035 LD, the

department has not made an access decision in relation to these documents as per

section 4 of the FOI Act. These documents are publicly available at:

https://www.health.gov.au/resources/foi-disclosure-log/foi-25-0035-ld-foi-charge-

notices.

I am satisfied that the searches undertaken were both thorough and reasonable in the

context of the scope of your request, the resources of the department, and the

requirements of the FOI Act and FOI Guidelines.

The Office of the Australian Information Commissioner publishes agency statistics

every year in their Annual Report. This contains information regarding charges issued

by agencies in regard to FOI requests, please note for the department, this includes the

Therapeutic Goods Administration (TGA).

For the purposes of administration, the TGA has a separate Freedom of Information

section and their documents have not been incorporated within this FOI request.

Should you wish to seek access to TGA documents you can contact

xxx.xxx@xxxxxx.xxx.xx.

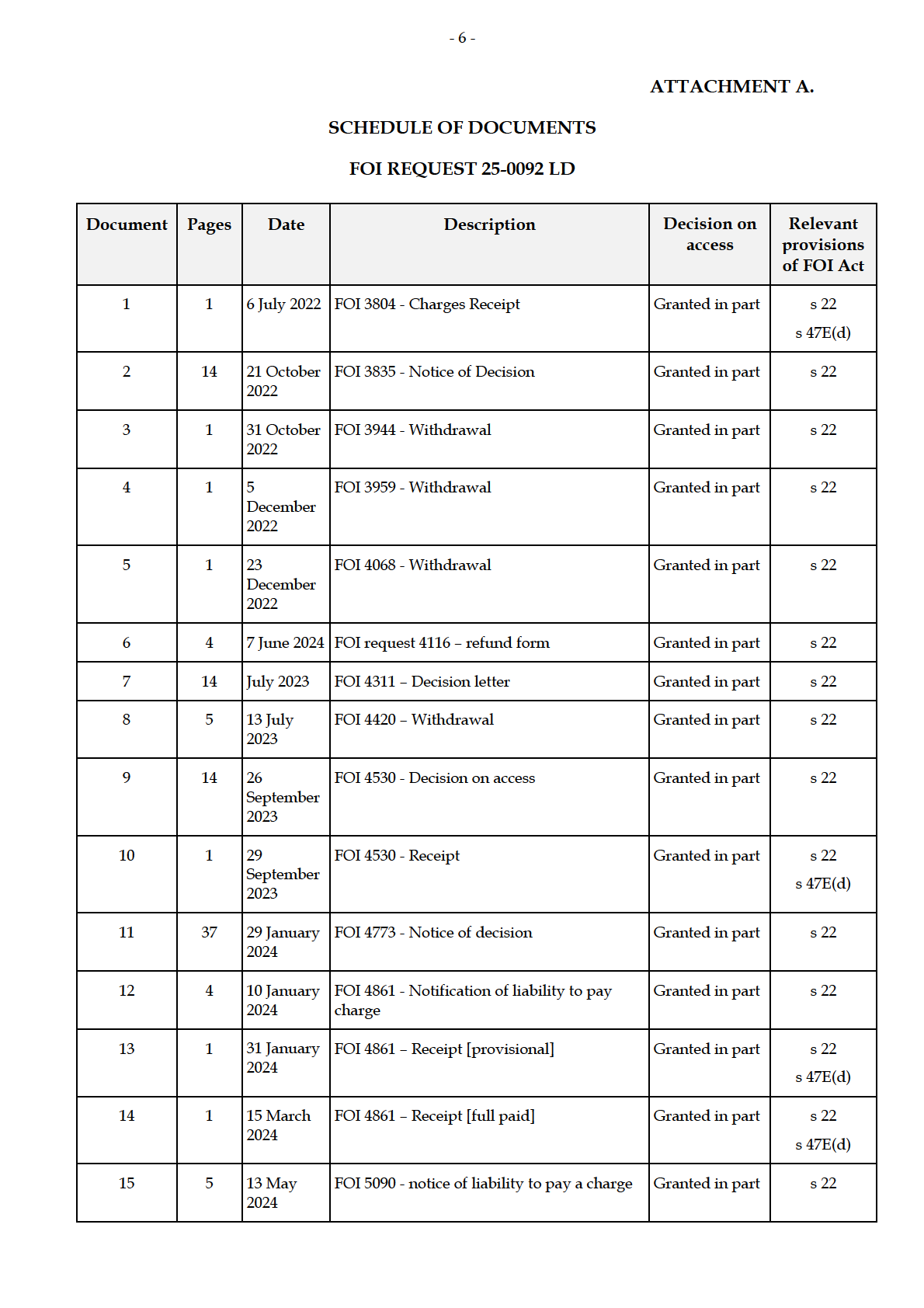

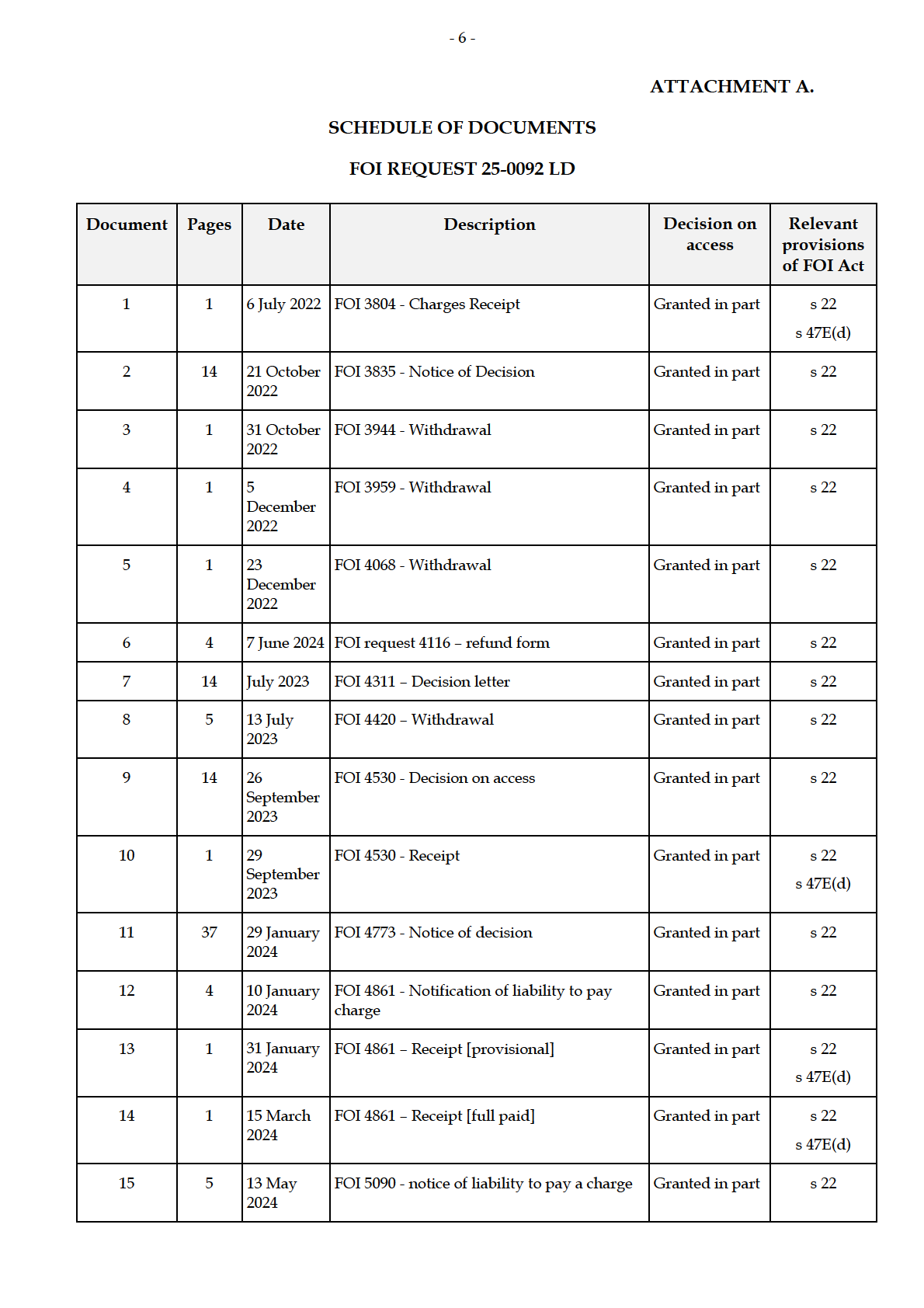

Decision on access

I have identified 20 documents that are relevant to your request. These documents

were in the possession of the department when your request was received.

You have requested access to information that is held in the department’s computer

systems. Pursuant to section 17 of the FOI Act, the department has used its computer

systems to produce a document that contains the information you are seeking to

access.

I have decided to grant access to a total of 21 documents in part, subject to the deletion

of irrelevant and exempt material.

A schedule setting out the documents relevant to your request, with my decision in

relation to those documents, is at

ATTACHMENT A.

- 5 -

My reasons for not providing access to material that has been deleted from the

documents are set out in

ATTACHMENT B.

Legislative provisions

The FOI Act, including the provisions referred to in my decision, is available on the

Federal Register of Legislation website: www.legislation.gov.au/Series/C2004A02562.

Your review rights

I have set out your review rights at

ATTACHMENT C.

Publication

Where I have decided to release documents to you, the department may also publish

the released material on its Disclosure Log, as required by section 11C of the FOI Act.

The department will not publish personal or business affairs information where it

would be unreasonable to do so.

For your reference the department’s Disclosure Log can be found at:

www.health.gov.au/resources/foi-disclosure-log.

Contacts

If you require clarification of any matters discussed in this letter you can contact the

FOI Section on (02) 6289 1666 or at xxx@xxxxxx.xxx.xx.

Yours sincerely

Authorised and electronically signed by

J. Kwong

Principal Lawyer

Legal Advice and Legislation Branch

Legal Division

02 December 2024

- 7 -

16

1

23 May

FOI 5090 - Receipt

Granted in part

s 22

2024

s 47E(d)

17

4

26 May

FOI 4387 - notice of liability to pay charge

Granted in part

s 22

2024

18

1

27 June

FOI 4387 - Withdrawal

Granted in part

s 22

2024

19

4

11 July

FOI 4492 - notice of liability to pay charge

Granted in part

s 22

2023

20

1

14 July

FOI 4492 - Receipt

Granted in part

s 22

2024

s 47E(d)

21

1

23 October FOI 3835 and 3838 Refund

Granted in part

s 22

2022

Section 17 document

s 47E(d)

- 8 -

ATTACHMENT B.

REASONS FOR DECISION

FOI 25-0092 LD

1. Material taken into account

In making my decision, I had regard to the following:

• the FOI Act

• guidelines issued by the Australian Information Commissioner under

section 93A of the FOI Act (FOI Guidelines)

• the terms of your FOI request as outlined above

• the content of the documents sought, and

• advice from departmental officers with responsibility for matters relating to

the documents sought.

2. Finding of facts and reasons for decision

My findings of fact and reasons for deciding that the exemptions identified in the

schedule of documents apply to the parts of documents are set out below.

3. Section 22 – deletion of irrelevant material

Section 22 of the FOI Act applies to documents containing exempt material

(subparagraph (1)(a)(i)) and irrelevant information (subparagraph (1)(a)(ii)) and

allows an agency to delete such material from a document.

I have deleted material in the documents which can reasonably be regarded as

irrelevant to your request as the information in the documents does not fall within the

scope of your FOI request. This includes:

• personal information of FOI applicants,

• details regarding other FOI requests, including the scope the request and other

details outlined in your initial request dated 5 November 2024 ,

• details regarding third parties, and

• details of other individuals, including public service employees.

An edited copy of the documents has been prepared and the irrelevant information

has been marked ‘s 22’ in the documents released to you.

4. Section 47E - Documents affecting certain operations of agencies

Section 47E of the FOI Act provides that a document is conditionally exempt if its

disclosure would, or could reasonably be expected to, do any of the following:

- 9 -

(a) prejudice the effectiveness of procedures or methods for the conduct of tests,

examinations or audits by an agency;

(b) prejudice the attainment of the objects of particular tests, examinations or

audits conducted or to be conducted by an agency;

(c) have a substantial adverse effect on the management or assessment of

personnel by the Commonwealth or by an agency;

(d) have a substantial adverse effect on the proper and efficient conduct of the

operations of an agency.

Section 47E(d)

Paragraph 6.120 of the FOI Guidelines states:

An agency’s operations may not be substantially adversely affected if the disclosure

would, or could reasonably be expected to lead to a change in the agency’s processes

that would enable those processes to be more efficient. For example, in Re Scholes and

Australian Federal Police [1996] AATA 347, the AAT found that the disclosure of

particular documents could enhance the efficiency of the Australian Federal Police as it

could lead to an improvement of its investigation process.

Paragraph 6.123 of the FOI Guidelines states that the predicted effect must bear on the

department’s ‘proper and efficient’ operations, that is, the department is undertaking

its expected activities in an expected manner. Where disclosure of the documents

reveals unlawful activities or inefficiencies, this element of the conditional exemption

will not be met and the conditional exemption will not apply.

I am satisfied that the parts of the documents marked ‘s47E(d)’ contain information,

namely phone numbers and email for collection of monies, which, if disclosed, would

or could reasonably be expected to, have a substantial and an unreasonable effect on

the department’s proper and efficient operations to conduct financial activities. These

are operational activities that are being undertaken in an expected and lawful manner

and would not reveal inefficiencies in the way in which the department conducts those

operational activities.

For the reasons outlined above, I have decided that the parts of the documents marked

‘s47E’ are conditionally exempt from disclosure under section 47E of the FOI Act.

Where a document is found to be conditionally exempt, the department must give

access to that document unless access to the document at this time would, on balance,

be contrary to the public interest. I have addressed the public interest considerations

below.

5. Disclosure is not in the public interest

Pursuant to subsection 11A(5) of the FOI Act, the department must give access to

conditionally exempt documents unless access to the documents at that time would,

on balance, be contrary to the public interest. I have therefore considered whether

disclosure of the documents would be contrary to the public interest.

- 10 -

Paragraph 6.224 of the FOI Guidelines states:

The public interest test is considered to be:

• something that is of serious concern or benefit to the public, not merely

of individual interest

• not something of interest to the public, but in the interest of the public

• not a static concept, where it lies in a particular matter will often depend

on a balancing of interests

• necessarily broad and non-specific and

• relates to matters of common concern or relevance to all members of the

public, or a substantial section of the public.

Factors favouring disclosure

Subsection 11B(3) of the FOI Act provides that factors favouring access to documents

in the public interest include whether access to the documents would do any of the

following:

• promote the objects of the FOI Act (including all matters set out in sections 3

and 3A)

• inform debate on a matter of public importance

• promote effective oversight of public expenditure, or

• allow a person to access his or her own personal information.

Having regard to the above, I consider that disclosure of the conditionally exempt

information at this time:

• would provide access to documents held by an agency of the Commonwealth

which would promote the objects of the FOI Act by providing the Australian

community with access to information held by the Australian Government.

• would not inform debate on a matter of public importance

• would not promote effective oversight of public expenditure, and

• would not allow you access to your own personal information.

Factors weighing against disclosure

I consider that the following public interest factors weigh against disclosure of the

conditionally exempt information at this time, on the basis that disclosure:

• could reasonably be expected to impede the flow of information to the

department for finances for payments and refunds.

- 11 -

In forming my decision, I confirm that I have not taken into account any of the

irrelevant factors set out in subsection 11B(4) of the FOI Act, which are:

(a) access to the document could result in embarrassment to the

Commonwealth Government, or cause a loss of confidence in the

Commonwealth Government;

(b) access to the document could result in any person misinterpreting or

misunderstanding the document;

(c) the author of the document was (or is) of high seniority in the agency to

which the request for access to the document was made;

(d) access to the document could result in confusion or unnecessary debate.

Conclusion

For the reasons set out above, after weighing all public interest factors for and against

disclosure, I have decided that, on balance, disclosure of the conditionally exemption

information would be contrary to the public interest. I am satisfied that the benefit to

the public resulting from disclosure is outweighed by the benefit to the public of

withholding the information. I have therefore redacted the conditionally exempt

information from the documents released to you.

- 12 -

ATTACHMENT C.

YOUR REVIEW RIGHTS

If you are dissatisfied with my decision, you may apply for a review.

Internal review

You can request internal review within 30 days of you receiving this decision. An

internal review will be conducted by a different officer from the original decision

maker.

No particular form is required to apply for review although it will assist your case to

set out the grounds on which you believe that the original decision should be changed.

Applications for internal review can be made by:

Email:

xxx@xxxxxx.xxx.xx

Mail:

FOI Unit (MDP 516)

Department of Health and Aged Care

GPO Box 9848

CANBERRA ACT 2601

If you choose to seek an internal review, you will also have a right to apply for

Information Commissioner review (IC review) of the internal review decision once it

has been provided to you.

Information Commissioner review or complaint

You have the right to seek Information Commissioner (IC) review of this decision. For

FOI applicants, an application for IC review must be made in writing within 60 days

of the decision. For third parties who object to disclosure of their information, an

application for IC review must be made in writing within 30 days of the decision.

If you are not satisfied with the way we have handled your FOI request, you can lodge

a complaint with the OAIC. However, the OAIC suggests that complaints are made to

the agency in the first instance.

While there is no particular form required to make a complaint to the OAIC, the

complaint should be in writing and set out the reasons for why you are dissatisfied

with the way your request was processed. It should also identify the Department of

Health and Aged Care as the agency about which you are complaining.

You can make an IC review application or make an FOI complaint in one of the

following ways:

• online at www.oaic.gov.au/freedom-of-information/reviews-and-

complaints/

• via email to xxxxx@xxxx.xxx.xx

• by mail to GPO Box 5218 Sydney NSW 2001, or

• by fax to 02 9284 9666.

- 13 -

More information about the Information Commissioner reviews and complaints is

available on the OAIC website here: www.oaic.gov.au/freedom-of-information/foi-

review-process.

Complaint

If you are dissatisfied with action taken by the department, you may also make a

complaint directly to the department.

Complaints to the department are covered by the department’s privacy policy. A form

for lodging a complaint directly to the department is available on the department’s

website here: www.health.gov.au/about-us/contact-us/complaints