FOI LEX 52027

Document 1

Document created under section 17 of the Freedom of Information Act 1982

Estimates of the number of debts potentially affected by income apportionment has changed over time as understanding of the historical use of

the practice has evolved.

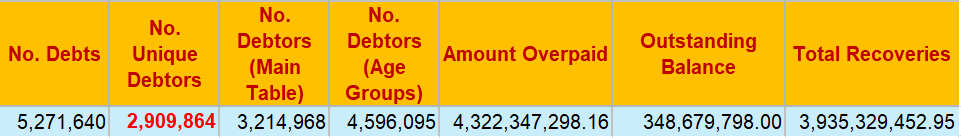

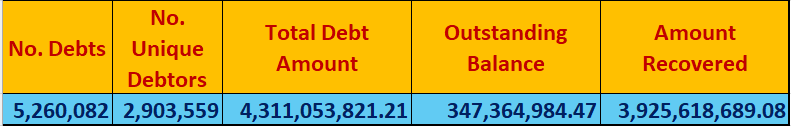

Best estimates to date (outlined in

Table 6), is at least 5.3 mil ion debts held by 2.9 mil ion Australians, totalling $4.3 bil ion,

may be impacted by

income apportionment. This estimate was produced on 22 October 2024.

This estimate reflects all debts where:

- The debt relates to employment income (either earned by the person receiving the payment, or their partner).

- The debt relates to a payment and time period in which it is likely income apportionment was used.

This estimate is based on information available in Services Australia’s Debt Management Information System. The Debt Management Information

System was established in 1993.

This estimate does not include:

- Debts attributed to deceased persons.

- Debts that have been overturned in full.

Notably, the 5.3 mil ion figure is

not an estimate of the number of debts af ected by income apportionment. Rather, it reflects those debts that

may be impacted by income apportionment. It is not possible to know whether a debt is affected by income apportionment without a manual

investigation of the debt.

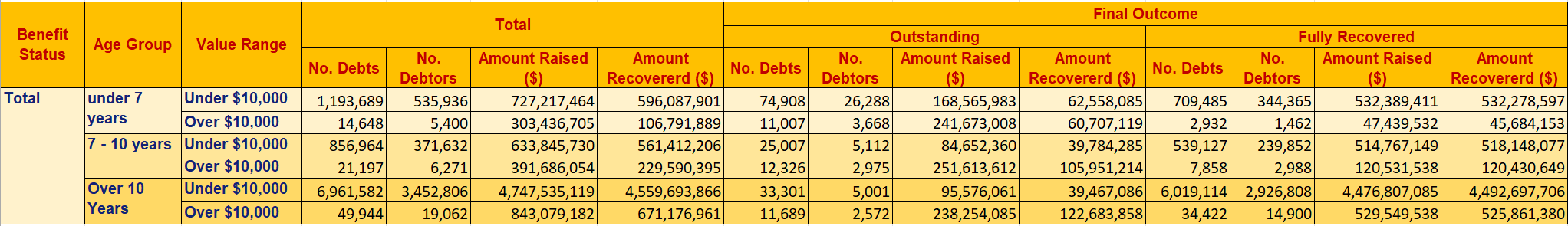

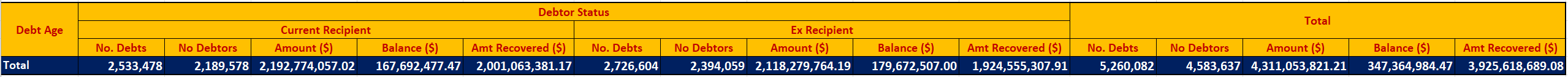

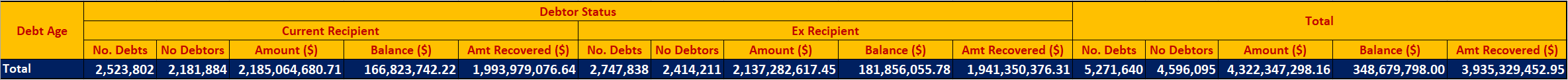

Table 1: Debts that may be impacted by Income Apportionment (status as at 30 June 2023 – Age as at 31 January 2024)

(data produced on 7 February 2024)

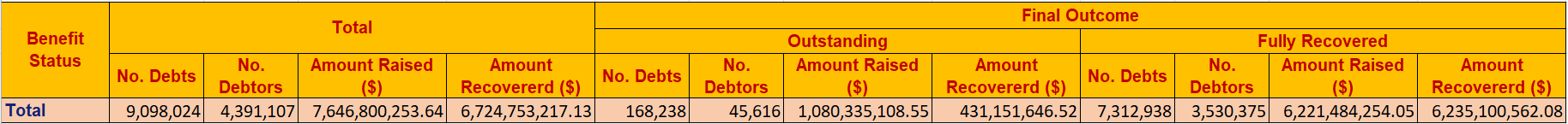

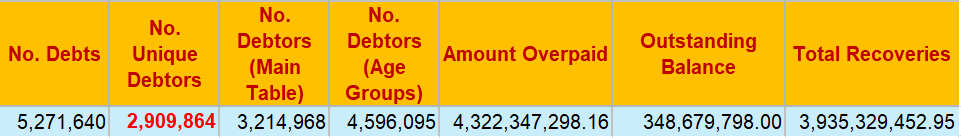

Table 2: Debts that may be impacted by Income Apportionment as at 30 June 2023

(data produced on 14 June 2024)

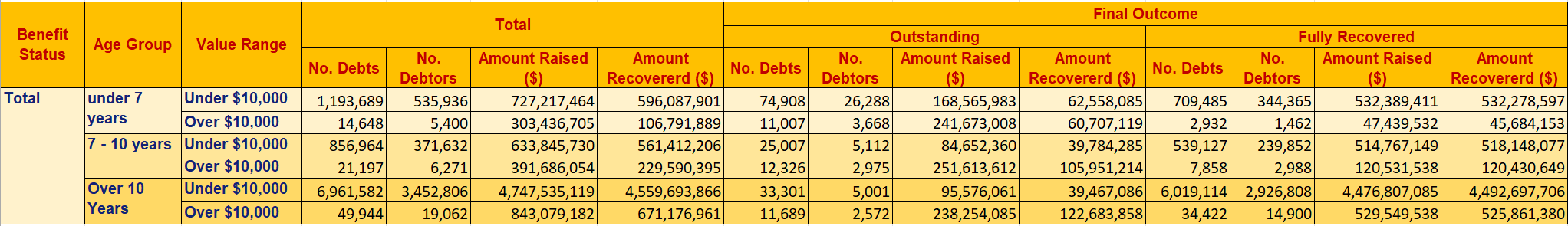

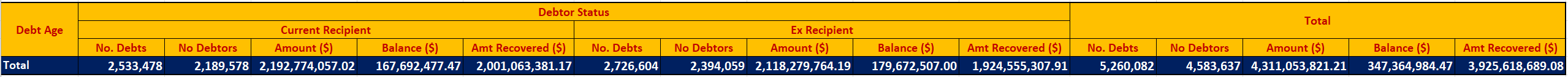

Table 3: Debts that may be impacted by Income Apportionment as at 16 August 2024

(data produced on 28 August 2024)

Table 1: Debts that may be impacted by Income Apportionment (status as at 30 June 2023 – Age as at 31 January 2024)

(data produced on 7 February 2024)

Table 2: Debts that may be impacted by Income Apportionment as at 30 June 2023

(data produced on 14 June 2024)

Table 3: Debts that may be impacted by Income Apportionment as at 16 August 2024

(data produced on 28 August 2024)

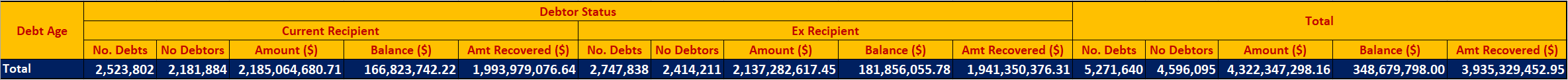

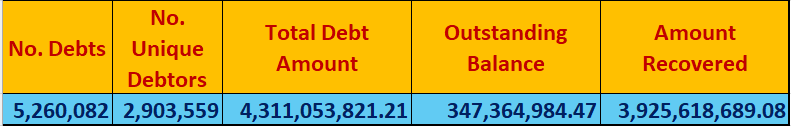

Table 4: Debts that may be impacted by Income Apportionment

(data produced on 28 August 2024)

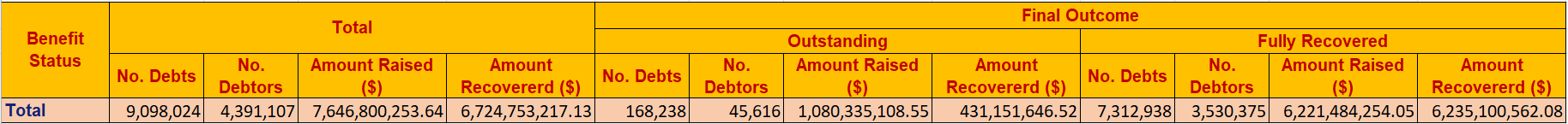

Table 5: Debts that may be impacted by Income Apportionment as at 22 October 2024

Table 6: Debts that may be impacted by Income Apportionment as at 22 October 2024