FOI 3766

QB24-000106

Document 1

Bank Branch Closures

KEY MESSAGE

•

Closing a bank branch is a commercial decision and banks need to explain

these decisions to their customers.

•

The Government is concerned about the impact of bank closures in rural and

regional Australia on communities who need access to face-to-face banking

services, as wel as on smal businesses that need to access and deposit

cash.

•

The Government is currently considering the recommendations within the

report by the Senate Rural and Regional Affairs and Transport References

Committee regarding Bank closures in regional Australia,

Protecting the future

of regional banking.

KEY FACTS AND FIGURES

•

Declines in the number of bank branches have been driven by shifts in

consumer demand, including from new technologies.

– Released on 18 October 2023, the Australian Prudential Regulation

Authority’s (APRA’s) Points of Presence publication showed that the

number of branches in regional and remote Australia fel by 34 per cent

from June 2017 to June 2023, mainly driven by the major banks.

•

Many of the services offered by branches are available in other ways.

– Telephone, internet, and mobile apps provide banking services in a way

that is convenient, fast, secure, and easy-to-use.

– Consumers and smal businesses can make withdrawals, deposits, and

balance enquiries at around 3,400 Australia Post offices through

Bank@Post.

•

The Senate Rural and Regional Affairs and Transport References Committee

(the Committee) released its report into bank closures in regional Australia on

24 May 2024.

•

The Committee made 8 recommendations:

Page 1 of 5

Office Responsible

Treasurer - The Hon Jim

Adviser

s 22

Chalmers MP

Contact Officer

s 22

Contact Number

s 22

Division responsible Financial System Division

Date of Update

30 September 2024

QB24-000106

BANKING

Bank Branch Closures

– Recognise access to financial services an essential service and commit to

guaranteeing reasonable access to cash and financial services for al

Australians.

– Commission an expert panel to investigate the feasibility of a publicly

owned bank, including using Australia Post’s branch network.

– Develop a mandatory code of conduct incorporating a robust branch

closure processes to be administered by a regulator. Require financial

institutions to consult with communities before a branch is closed, report

on the potential impacts of closure, identify alternative financial services in

the event of closure, and fund transition arrangements and ongoing

support services fol owing a closure.

– Authorising the regulator to approve or defer closure requests, direct

banks to take certain reasonable actions and apply penalties if a bank fails

to comply with an order to defer closure.

– Commission the ACCC to explore the barriers to customers switching

banks.

– Establish a Regional Community Banking Branch Program to help

underwrite the establishment of ‘community bank’ branches. Local

Government would be required to raise their own capital as wel . Consider

whether to use this fund to enhance financial services available at

Australia Post. Hypothecate funds from a supplement to the Major Banks

Levy to fund the program.

– Require al major banks to have agreements with Bank@Post and to

harmonise the terms of Bank@Post agreements to improve fairness and

sustainability. Levy major banks which do not put in place agreements with

Bank@Post.

– ACCC consider measures to protect access to personal and business

banking in regional, rural and remote locations, including proposing

authorisations to circumvent anti-competitive laws such that banks can

Page 2 of 5

Office Responsible

Treasurer - The Hon Jim

Adviser

s 22

Chalmers MP

Contact Officer

s 22

Contact Number

s 22

Division responsible Financial System Division

Date of Update

30 September 2024

QB24-000106

BANKING

Bank Branch Closures

cooperate for the purpose of reducing the impact of branch closures in

regional communities.

•

As part of the Government’s recent approval of ANZ’s acquisition of Suncorp

Bank, ANZ agreed to conditions which include:

– No regional bank branch closures for ANZ or Suncorp Bank for 3 years.

– No net job losses across Australia, including regional Australia for Suncorp

Bank and ANZ, as a result of the transaction, for three years.

– Suncorp Bank to renew its current agreement with Australia Post for the

provision of Bank@Post services for a minimum of three years.

–

ANZ to make best endeavours to join Bank@Post on commercial terms for

a minimum of three years.

Page 3 of 5

Office Responsible

Treasurer - The Hon Jim

Adviser

s 22

Chalmers MP

Contact Officer

s 22

Contact Number

s 22

Division responsible Financial System Division

Date of Update

30 September 2024

QB24-000106

BANKING

Bank Branch Closures

BACKGROUND

Points of Presence statistics

•

Released on 18 October 2023, APRA’s Points of Presence publication showed

that the number of branches in regional and remote Australia fel by

34 per cent from June 2017 to June 2023, mainly driven by the Major Banks.

– The decline in regional and remote branches was lower than the decline in

the number of branches in metro areas, which fel by 39 per cent over the

same period

– However, the decline in bank branches across Australia of 11 per cent

from June 2022 to June 2023 represents the largest annual percentage

decline in the number of bank branches in 6 years

– Westpac was the largest contributor to bank branch closures, closing

61 regional and remote branches (24 per cent of its network), and a total

of 167 branches across Australia (22 per cent of its network) from

June 2022 to June 2023. This decline is in part due to the consolidation of

branches of brands under the Westpac Group.

•

The next annual data release is expected on 16 October 2024.

Bank@Post

•

Bank@Post involves around 3,400 Post Offices acting as an agent for banks,

providing banking services to customers of over 80 banks and other financial

institutions. This includes more than 1,800 Post Offices in rural and remote

locations.

– CBA, NAB and Westpac al offer services through Bank@Post. ANZ and

Macquarie do not currently participate in Bank@Post

– Bank@Post services include depositing cash and cheques, withdrawing

cash and checking account balances

– Separate to Bank@Post, Australia Post also offers other financial services

including Post Bil Pay, currency exchange, insurance and international

money transfer with Western Union.

Page 4 of 5

Office Responsible

Treasurer - The Hon Jim

Adviser

s 22

Chalmers MP

Contact Officer

s 22

Contact Number

s 22

Division responsible Financial System Division

Date of Update

30 September 2024

QB24-000106

BANKING

Bank Branch Closures

•

On 18 June 2024 Australia Post stated that Bank@Post is on a trajectory of

significant financial losses unless bank partners provide additional funding

while appearing at the Environment and Communications Legislation

Committee.

•

The Government is currently considering the recommendations within the

report by the Senate Rural and Regional Affairs and Transport References

Committee regarding Bank closures in regional Australia, which include

recommendations relating to Bank@Post.

Recent changes announced by banks

•

ANZ announced it would be closing its Katoomba branch in October 2024,

sparking incorrect claims that the bank is violating the conditions of the

Suncorp acquisition.

– Katoomba is not classified a regional area according to the Australian

Bureau of Statistics’ Australian Statistical Geography Standard.

– The bank states that it has given a six month notice period in accordance

with the Australian Banking Association’s Branch Closure Support

Protocol.

•

In August 2024, Bank of Queensland announced it would be abandoning its

franchise network model and would be taking control of 114 franchised outlets

from March 2025 at a cost of up to $125 mil ion.

– Bank of Queensland announced the changes would provide further

opportunities to consolidate branches as customers shift to digital

channels.

Page 5 of 5

Office Responsible

Treasurer - The Hon Jim

Adviser

s 22

Chalmers MP

Contact Officer

s 22

Contact Number

s 22

Division responsible Financial System Division

Date of Update

30 September 2024

FOI 3766

Document 2

s 47F

s 47F

FOI 3766

Document 3

s 47F

s 47F

FOI 3766

Document 4

s 47F

s 47F

FOI 3766

Document 5

s22

From:

Jones DLO

Sent:

Monday, 19 August 2024 3:57 PM

To:

Min Processing

Cc:

Jones DLO

Subject:

FSD - ANZ Bank Branch in Bega

OFFICIAL

Department response please.

s22

Office of the Hon Stephen Jones MP

Assistant Treasurer and Minister for Financial Services

s22

E xxxxxxxx@xxxxxxxx.xxx.xx

M1.27, Parliament House, Canberra, ACT 2600

LGBTIQ+ Ally

The Treasury acknowledges the tradi onal owners of country throughout Australia, and their con nuing connec on to land,

water and community. We pay our respects to them and their cultures and to elders both past and present.

OFFICIAL

From: s22

Sent: Monday, August 19, 2024 3:45 PM

To: Jones DLO <xxxxxxxx@xxxxxxxx.xxx.xx>

Subject: FW: Website Contact

From: Chalmers, Jim (MP) <xxx.xxxxxxxx.xx@xxx.xxx.xx>

Sent: Monday, August 19, 2024 3:41 PM

To: Jones, Stephen (MP) <xxxxxxx.xxxxx.xx@xxx.xxx.xx>

Fully out of scope

Subject: FW: Website Contact

pages have been

deleted from the

Hi team,

document set

The following correspondence has been reviewed and this office considers that the matter raised falls more

appropriately within your portfolio responsibility. Therefore, we’re referring it to your office for your attention and

consideration.

Kind regards,

Office of the Hon. Jim Chalmers MP | Treasurer and Federal Member for Rankin

From: s 47F

On Behalf Of s 47F

Sent: Sunday, August 18, 2024 10:12 AM

To: Chalmers, Jim (MP) <xxx.xxxxxxxx.xx@xxx.xxx.xx>

Subject: Website Contact

1

FOI 3766

Document 6

s22

From:

Chalmers, Jim (MP) <xxx.xxxxxxxx.xx@xxx.xxx.xx>

Sent:

Monday, 19 August 2024 2:49 PM

To:

Min Processing

Subject:

FSD - Bank Closures

From: s 47F

On Behalf Of s 47F

Sent: Sunday, August 18, 2024 8:16 PM

To: Chalmers, Jim (MP) <xxx.xxxxxxxx.xx@xxx.xxx.xx>

Subject: Website Contact

s 47F

1

FOI 3766

Document 7

s22

From:

s 22

@aph.gov.au>

Sent:

Friday, 23 August 2024 12:57 PM

To:

Min Processing

Cc:

Jones DLO

Subject:

FSD - Bega Valley who is also a customer of ANZ bank

From: Chalmers, Jim (MP) <xxx.xxxxxxxx.xx@xxx.xxx.xx>

Sent: Wednesday, August 21, 2024 4:34 PM

To: Jones, Stephen (MP) <xxxxxxx.xxxxx.xx@xxx.xxx.xx>

Subject: FW: Website Contact

Hi Team,

The following correspondence has been reviewed and this office considers that the matter raised falls more

appropriately within your portfolio responsibility. Therefore, we’re referring it to your office for your attention and

consideration.

Kind regards,

Office of the Hon. Jim Chalmers MP | Treasurer and Federal Member for Rankin

From:s 47F

On Behalf Of s 47F

Sent: Wednesday, August 21, 2024 1:59 PM

To: Chalmers, Jim (MP) <xxx.xxxxxxxx.xx@xxx.xxx.xx>

Subject: Website Contact

s 47F

FOI 3766

Document 8

s22

s 22

From: s22

@TREASURY.GOV.AU>

Sent: Wednesday, July 10, 2024 5:30 PM

To: s22

@TREASURY.GOV.AU>

Subject: RE: ANZ Regional Bank Closures - constituent inquiry [SEC=OFFICIAL]

OFFICIAL

Yes, please. Let me know how you go.

Thanks s22

Kind regards,

________

s22

Office of the Hon Jim Chalmers MP | Treasurer

s22

E s22

@treasury.gov.au

OFFICIAL

From: s22

@TREASURY.GOV.AU>

Sent: Wednesday, July 10, 2024 5:29 PM

To: s22

@TREASURY.GOV.AU>

Subject: RE: ANZ Regional Bank Closures - constituent inquiry [SEC=OFFICIAL]

OFFICIAL

Hi s22

1

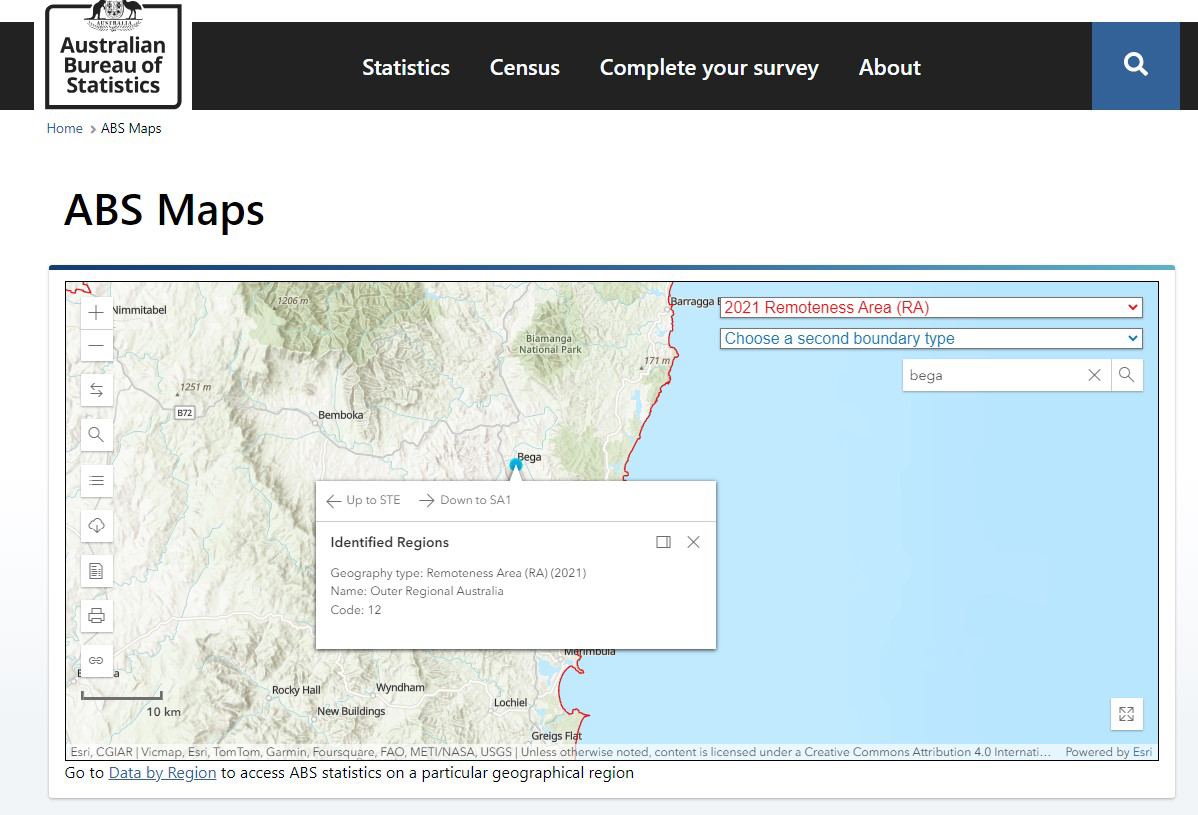

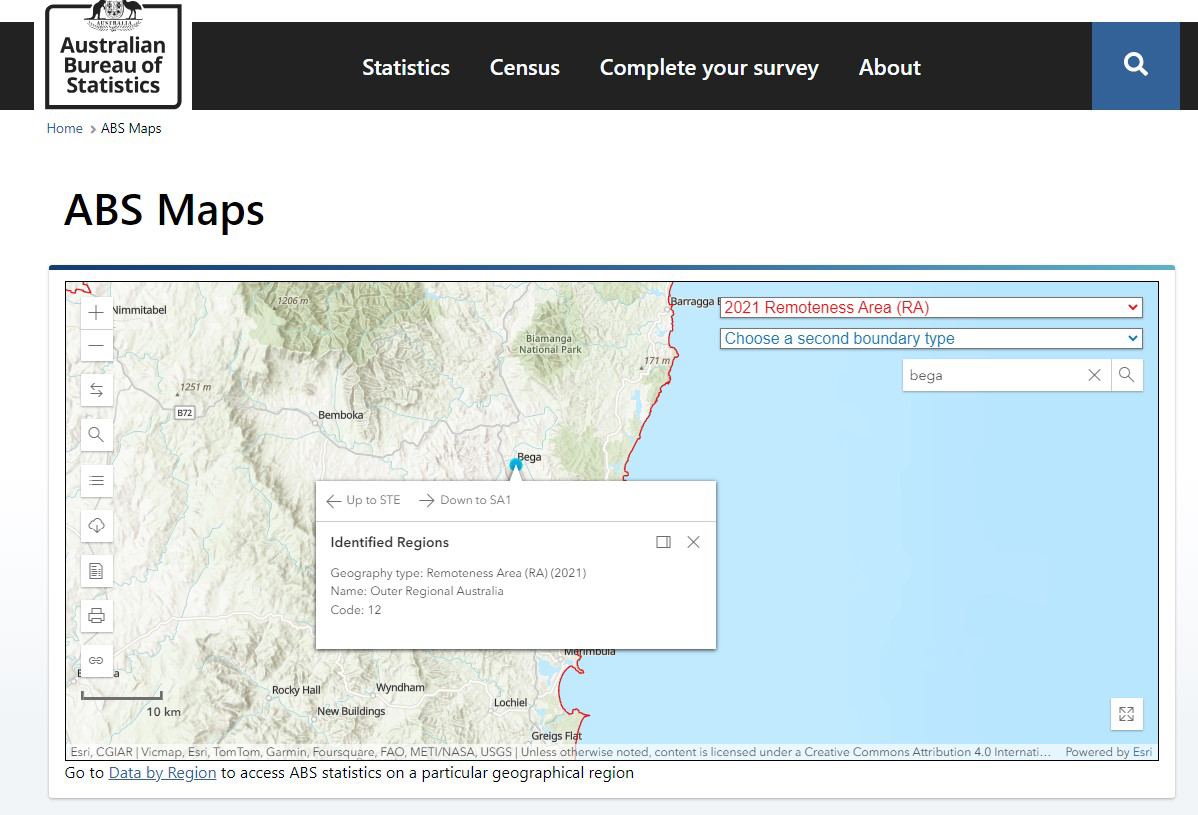

See ABS map of remoteness areas as against the Australian Sta s cal Geography Standard (ASGS) Edi on 3, as

published by the Australian Sta s cian on 20 July 2021.

You will see that Bega is in “outer regional australia” which is covered by the ANZ/Suncorp branch closure

commitment.

Did you want me to raise with s22

Kind regards,

s22

Banking Unit, Financial System Division

The Treasury, 1 Langton Cres, Parkes, ACT 2603

s22

Twi er | LinkedIn | Facebook

The Treasury acknowledges the tradi onal owners of country throughout Australia, and their con nuing connec on to land,

water and community. We pay our respects to them and their cultures and to elders both past and present.

LGBTIQ+ Ally

OFFICIAL

From: s22

@TREASURY.GOV.AU>

Sent: Wednesday, July 10, 2024 5:16 PM

To: s22

@TREASURY.GOV.AU>

Subject: FW: ANZ Regional Bank Closures - constituent inquiry [SEC=OFFICIAL]

2

OFFICIAL

Hi s22

Is this branch outside the commitment? Thanks.

Kind regards,

________

s22

| Office of the Hon Jim Chalmers MP | Treasurer

s22

@treasury.gov.au

OFFICIAL

From: Chalmers CLO <xxxxxxxxxxx@xxxxxxxx.xxx.xx>

Sent: Wednesday, July 10, 2024 4:58 PM

To: s22

@TREASURY.GOV.AU>

Subject: FW: ANZ Regional Bank Closures - constituent inquiry [SEC=OFFICIAL]

OFFICIAL

OFFICIAL

His22

Do you have any advice on a response to this one at all?

Thanks,

s22

OFFICIAL

OFFICIAL

From: s 22

@aph.gov.au>

Sent: Wednesday, July 10, 2024 4:55 PM

To: Chalmers CLO <xxxxxxxxxxx@xxxxxxxx.xxx.xx>

Subject: ANZ Regional Bank Closures - constituent inquiry

Dear s22

s 47F

s 47F

who is most upset that the Bega ANZ branch is closing in October, with the

closest branch now a 3 hour drive away in Woden.

s 47F

s 47F

all was fine given the announcement that ANZ was purchasing Suncorp and

had read in the SMH (Sat 29 June)

“As part of the approval, Chalmers announced requirements that wil stop ANZ and Suncorp from closing regional branches

across Australia for three years”

However bank workers in the Bega branch have told s 47F

that the branch will still be closing.

s 47F contacted us to clarify why this is happening.

3

Can you advise? Note that the announcement to close the branch was made a number of weeks before the

announcement of the terms of the merger.

Many thanks

s 22

O ice of the Hon Kristy McBain

Member for Eden-Monaro

1/21-25 Monaro Street | Queanbeyan NSW 2620 | 02 6284 2442

1/225 Carp Street | Bega NSW 2550 | 02 6492 0542

Parliament House | Canberra ACT 2600 | 02 6277 7060

We acknowledge the Ngambri, Ngunnawal, Wiradjuri, Ngarigo and Yuin people as Traditional Owners

of Country in the Eden-Monaro Electorate.

We recognise their continuing connection to lands, waters and communities and pay our respect to

Aboriginal and Torres Strait Islander cultures; and to Elders past, present and emerging

4

FOI 3766

Document 9

s22

s 22

From: Media <xxxxx@xxxxxxxx.xxx.xx>

Sent: Wednesday, August 21, 2024 12:29 PM

To: s22

@TREASURY.GOV.AU>

Subject: RE: Bega ANZ branch [SEC=OFFICIAL]

OFFICIAL

Thank you s22

s22

Media, Communications Branch

OFFICIAL

From: s22

@TREASURY.GOV.AU>

Sent: Tuesday, August 20, 2024 5:08 PM

To: s22

@TREASURY.GOV.AU>; Media <xxxxx@xxxxxxxx.xxx.xx>; s22

@TREASURY.GOV.AU>

Subject: RE: Bega ANZ branch [SEC=OFFICIAL]

OFFICIAL

I have spoken to ANZ and they have confirmed that they are about to announce that they are reversing the prior

announcement that they are closing the Bega branch.

We can tell the office that

1

Kind regards,

s22

Banking Unit, Financial System Division

The Treasury, 1 Langton Cres, Parkes, ACT 2603

s22

Twi er | LinkedIn | Facebook

The Treasury acknowledges the tradi onal owners of country throughout Australia, and their con nuing connec on to land,

water and community. We pay our respects to them and their cultures and to elders both past and present.

LGBTIQ+ Ally

OFFICIAL

From: s22

@TREASURY.GOV.AU>

Sent: Tuesday, August 20, 2024 4:09 PM

To: Media <xxxxx@xxxxxxxx.xxx.xx>; s22

@TREASURY.GOV.AU>

Cc: s22

@TREASURY.GOV.AU>

Subject: RE: Bega ANZ branch [SEC=OFFICIAL]

OFFICIAL

Very much appreciated – Thanks s22

Kind regards

s22

OFFICIAL

From: Media <xxxxx@xxxxxxxx.xxx.xx>

Sent: Tuesday, August 20, 2024 4:08 PM

To: s22

@TREASURY.GOV.AU>; Media <xxxxx@xxxxxxxx.xxx.xx>; s22

@TREASURY.GOV.AU>

Cc: s22

@TREASURY.GOV.AU>

Subject: RE: Bega ANZ branch [SEC=OFFICIAL]

OFFICIAL

Thank you s22 and all.

s 47E(d)

Kind regards,

s22

2

s22

Media, Communications Branch

OFFICIAL

From: s22

@TREASURY.GOV.AU>

Sent: Tuesday, August 20, 2024 4:03 PM

To: Media <xxxxx@xxxxxxxx.xxx.xx>; s22

@TREASURY.GOV.AU>

Cc: s22

@TREASURY.GOV.AU>

Subject: RE: Bega ANZ branch [SEC=OFFICIAL]

OFFICIAL

Hi s22

Upfront we want to be very clear that we have no information confirming whether the Bega ANZ Branch is or is

not closing.

To that end we, received some ministerial correspondence from a member of the public two days ago (18

August 2024) asking the treasurer to please stop the branch being closed. As you mentioned you have raised

this with the T.O, please find below some background context of the ANZ-Suncorp merger conditions.

On 28 June 2024, the Treasurer announced that ANZ’s proposed acquisition of Suncorp Bank could only

proceed subject to strict conditions directed at protecting the customers and staff of both organisations.

The Treasurer required that:

For a period of three years, there be no net reduction in regional and remote bank branches

operated by ANZ or Suncorp Bank, Australia wide.

For a period of three years, there be no net job losses as a result of the transaction across both

organisations, Australia wide.

Suncorp maintain its agreements with Bank@Post and ANZ make best endeavours to join

Bank@Post.

The Bega ANZ branch was covered by the first of these conditions imposed by the Treasurer, as a ‘regional’

ANZ bank branch.

Let us know if you have any further questions.

Kind regards

s22

OFFICIAL

From: Media <xxxxx@xxxxxxxx.xxx.xx>

Sent: Tuesday, August 20, 2024 2:42 PM

To: s22

@TREASURY.GOV.AU>; s22

@TREASURY.GOV.AU>; Media <xxxxx@xxxxxxxx.xxx.xx>

Subject: FW: Bega ANZ branch [SEC=OFFICIAL]

Importance: High

OFFICIAL

3

Hi s22

s 47E(d)

They would like some context/info that might connect with Government policy please.

Can you suggest some lines that might be helpful?

Thank you kindly,

s22

Media, Communications Branch

OFFICIAL

From: s22

@TREASURY.GOV.AU>

Sent: Tuesday, August 20, 2024 2:04 PM

To: Media <xxxxx@xxxxxxxx.xxx.xx>

Cc: Treasurer Media <xxxxxxxxxxxxxx@xxxxxxxx.xxx.xx>

Subject: FW: Bega ANZ branch [SEC=OFFICIAL]

Importance: High

OFFICIAL

Team can you prepare a response to below please.

Think this is the result of our policy.

s22

From: s 47F

Sent: Tuesday, August 20, 2024 11:27 AM

To: Chalmers, Jim (MP) <xxx.xxxxxxxx.xx@xxx.xxx.xx>

Subject: Bega ANZ branch

Hello,

I have heard the Bega ANZ branch may not be closing and will instead have it’s opening hours reduced?

This is big news for the regional community. Can you confirm?

Thanks for your time.

s 47F

4

FOI 3766

Document 10

s22

s 22

From: s22

Sent: Wednesday, July 10, 2024 5:51 PM

To: s 22

@anz.com>

Cc: Preston, Robb s22

s22

@TREASURY.GOV.AU>

Subject: Regional Branch Closures [SEC=OFFICIAL]

OFFICIAL

Hi s 47F

The Treasurer’s office have advised that they have been contacted by the Member for Eden-Monaro.

s 47F

s 47F

when asking if the ANZ/Suncorp approval announcement means it is no longer

closing in October, ANZ branch staff have told them that the branch will s ll be closing.

The office has asked us to reach out to ANZ and ask for confirma on that (as per the ABS regional areas map below)

Bega is caught by the branch closures freeze?

1

Kind regards,

s22

Banking Unit, Financial System Division

The Treasury, 1 Langton Cres, Parkes, ACT 2603

s22

Twi er | LinkedIn | Facebook

The Treasury acknowledges the tradi onal owners of country throughout Australia, and their con nuing connec on to land,

water and community. We pay our respects to them and their cultures and to elders both past and present.

LGBTIQ+ Ally

OFFICIAL

2

FOI 3766

Document 11

s22

From:

s22

Sent:

Monday, 9 September 2024 3:20 PM

To:

s22

Cc:

Baird, Tim; Kelly, Lynn

Subject:

Katoomba ANZ branch closing [SEC=OFFICIAL]

OFFICIAL

Hi s22

Heads up on possible issue that might develop. ANZ is shu ng the Katoomba branch. s 47E(d)

.

People may ques on why it is permi ed notwithstanding the Suncorp FSSA condi ons.

Is that a Banking Unit issue (as it relates to FSSA condi ons) or is it a Retail Banking Unit issue (as it related to

regional bank branches)?

It is not in breach of the Suncorp FSSA condi on not to close regional or remote branches – Katoomba is classified as

‘major capital city’.

See map

h ps://maps.abs.gov.au/ Choose boundary: “2021 Remoteness Area”. Search for Katoomba. Right click on the

town to get the ABS remoteness classifica on (which is what the FSSA condi ons use in the prohibi on of branch

closures in regional or remote Australia)

Kind regards,

s22

Banking Unit, Financial System Division

The Treasury, 1 Langton Cres, Parkes, ACT 2603

s22

Twi er | LinkedIn | Facebook

The Treasury acknowledges the tradi onal owners of country throughout Australia, and their con nuing connec on to land,

water and community. We pay our respects to them and their cultures and to elders both past and present.

LGBTIQ+ Ally

OFFICIAL

1

FOI 3766

Document 12

s22

From:

s22

Sent:

Thursday, 5 September 2024 2:54 PM

To:

MG FSD Banking; s22

Cc:

s22

Subject:

RE: For info: ANZ appearance at House of Representatives, Standing Committee,

Economics Today - Notes [SEC=OFFICIAL]

Attachments:

s22

OFFICIAL

Hi All

Building on s22

notes below, please find a ached the transcripts from both days of this commi ee which have

now been made available for reference.

Kind regards,

s22

Banking Unit | Financial System Division

Markets Group

The Treasury acknowledges the traditional owners of country throughout Australia, and their continuing connection to land,

water and community. We pay our respects to them and their cultures and to elders both past and present.

OFFICIAL

From: s22

@TREASURY.GOV.AU>

Sent: Friday, August 30, 2024 3:55 PM

To: MG FSD Banking <xxxxxxxxxxxx@xxxxxxxx.xxx.xx>; s22

@treasury.gov.au>; s22

@TREASURY.GOV.AU>; s22

@TREASURY.GOV.AU>

Subject: For info: ANZ appearance at House of Representatives, Standing Committee, Economics Today - Notes

[SEC=OFFICIAL]

OFFICIAL

Hi all,

Thought I would circulate some notes given there is some topical issues that were discussed at ANZ’s appearance to

the Standing Commi ee today (so far).

Feel free to on-send.

ANZ A endees

Mr Shayne Ellio , Chief Execu ve Officer and Execu ve Director

Mrs Maile Carnegie, Group Execu ve, Australia Retail

s 22

s 22

Regional banking

Leaned on condi ons placed on the bank under the FSSA for response to ques ons on bank branches and

Bank@post.

o Unable to close branches for 3 years

o Must make best endeavours to progress dealings with Australia Post on par cipa on in Bank@post.

Main reason not already signed up to Bank@post is that they believed the deal for them to join was

unfavourable compared to the other major banks.

o Smallest retail bank of the majors, less than half the size of CBA. Offer that non-majors received was

significantly cheaper.

o Have inherited Suncorp Bank’s Bank@post agreement which they will be able to learn from and

honour.

No silver bullet for regional banking. Challenge around the world but Australia has addi onal challenges due

to its geographic size.

In response to vulnerable cohorts such as elderly cohorts being impacted by branch closures:

o “Bright future for branches”.

o For the convenience of the majority can’t leave behind minority.

s 22

Kind regards,

s22

Banking Unit, Financial System Division

Phs22

The Treasury acknowledges the tradi onal owners of country throughout Australia, and their con nuing connec on to land,

water and community. We pay our respects to them and their cultures and to elders both past and present.

OFFICIAL

2

FOI 3766

Document 12a

COMMONWEALTH OF AUSTRALIA

Proof Committee Hansard

HOUSE OF

REPRESENTATIVES

STANDING COMMITTEE ON ECONOMICS

Review of Australia’s four major banks

(Public)

FRIDAY, 30 AUGUST 2024

CANBERRA

CONDITIONS O

F DISTRIBUTION

This is an uncorrected proof of ev

idence taken before the committee.

It is made available under the condition that it is recognised as such.

BY AUTHORITY OF THE HOUSE OF REPRESENTATIVES

[PROOF COPY]

Friday, 30 August 2024

House of Representatives

Page 58

Part of that will come down to the necessity for investment in the broader sense, whether that's foreign

investment or whether that's domestic investment. My predecessor used to say, quite rightly, that capital goes

where it's welcome. Despite all the prosperity in this nation, we're still a growing country and a country of

opportunity. That will require capital, and we need to be a welcoming place for that capital. A welcoming place

for capital means regulatory settings and tax settings but also the broader social environment. Is this a place that

celebrates success, encourages entrepreneurship and celebrates large, successful businesses or not? There is a lot

there that I think the government can do.

With your question, I know you're interested in tax. That's not an area of my expertise, but tax matters. It is one

of those factors that play into it. In my experience—and I've worked in multiple places around the world—and

taking my role as the CEO of ANZ and talking to a lot of our customers, which tend to be the big end of town,

companies can deal with all sorts of settings, and they'll make do. What they're really looking for is clarity,

predictability and simplicity. All three of those things to some extent could be worked on in Australia.

Ms SPENDER: Thank you. I appreciate your time. I'll hand back to the chair.

CHAIR: I just have a couple of quick follow-ups. Firstly, we talked earlier about regional and rural bank

closures. Can you just remind me what the current position is?

Mr Elliott: We agreed with the federal Treasurer that we will not close any regional branches, either Suncorp

or ANZ, for a period of three years from the date of acquisition, which was a month ago.

CHAIR: I've had some feedback that there's active discussion going on in, I think, Katoomba and

Murwillumbah around this and that there are actually petitions and discussions in the community and pushback on

some scheduled closures for October.

Mr Elliott: They were ones that were already in train before the condition was even discussed with us.

Outside of the current moratorium, there's quite a long consultation period, and we give communities a reasonable

amount of notice. We say, 'This is what we're going to do,' and we talk to people about what alternatives will be

put in place. Some of those had already started. When the federal Treasury put the requirements in place, they

were literally right towards the end of our negotiations. When we kicked off those branch closures, we weren't

aware that we were going to make that obligation, and that's why they were caught in the middle. We're relooking

at those ones.

CHAIR: So you're relooking at them?

Mr Elliott: Yes.

Mrs Carnegie: Specifically, with Katoomba, we are planning to go through with that closure. There were four

branches that were caught up in that zone where we had announced the closures before we knew about the

requirement as part of the Suncorp acquisition. We have reversed two of them because they were clearly in

regional areas and we were able to reverse them. We are going forward with Katoomba, and we have shared this

with the government. The issue with Murwillumbah is that that branch is actually not fit for purpose, and so we're

closing it, but we are actively exploring an alternative site.

Mr Elliott: Just to be clear, it is not fit for purpose for health reasons.

Mrs Carnegie: Yes.

CHAIR: Is this post floods?

Mr Elliott: It's suffering from mould, so it's not habitable by people.

Mrs Carnegie: Yes.

CHAIR: Okay. I might follow up with clarification on those two. It's an awkward one. I can imagine that in

those communities they kind of see a commitment, and it would be jarring. I'm interested also in your analysis of

community need for branches, and this isn't just regional and rural; this is face-to-face engagement. I'm interested

in the extent to which you've undertaken analysis of how much, for example, elderly customers—but also

potentially others—might end up relying upon family members or friends to do their banking for them or

basically be a person who helps them with their banking.

Mrs Carnegie: Obviously, before we close a branch, we understand that, as you said, regardless of whether

it's regional, rural or in the city, there are members of the community that use the branches and they're a

significant part of their current habits and practices. So we don't, obviously, close a branch lightly, but, when we

do, one of the things we have in place is a customer care team. What that customer care team will do is go and

actually analyse our customer data to identify anybody who is over the age of 65 and anybody who has used the

branch more than two times in the last, I think, six months. We'll also identify small businesses that are frequent

ECONOMICS COMMITTEE

Friday, 30 August 2024

House of Representatives

Page 59

users of the branch. So we kind of have a filter to try and recognise who are people who are most at risk of

finding the branch closure difficult.

We will proactively reach out to those individuals—the customer care team will—and we will start working

with them, well in advance of the branch closure, to start to help them understand what alternatives there may be.

So, firstly, we seek to understand what their needs are and then put in place alternatives for them. A lot of that is

to do with education: 'Actually, you can do this via the ATM.' We will go and literally do in-person sessions with

them to help them understand how they can do that. It might be phone branching. So we will go through a series

of steps, and then the team will identify whether or not there are individuals who then need follow-up post the

branch closure. So we try and wrap as much support as we can around the closure of that branch, again through

the identification. When I talk to that team, obviously, they have mentioned times where people have got family

members who can support them, but we work with them to try and help to identify how the individual can do the

banking themselves. I can go back and understand how big a problem that is, and I can take that on notice.

CHAIR: Yes, that would be useful. Sometimes it works well. Sometimes families want to do that. Sometimes

it can lead to exposures, obviously.

Mrs Carnegie: Yes.

CHAIR: I saw this in my electorate in COVID, where a lot of older people used their children—or not used

but worked with their children—to navigate government services or banking or whatever it might be.

Mrs Carnegie: Yes.

CHAIR: And then suddenly the five-kay limit meant they couldn't do that easily, and it really led to a lot of

challenging situations. So a follow-up on that would be great.

One of the issues, obviously, coming out of the royal commission—I'll put this to all of the banks—was that,

where there were clear cases of poor behaviour, the banking industry—I think Anna Bligh said this—said, 'We'll

pay every penny back.' Are you aware of how many legacy cases are still unresolved at this point?

Mrs Carnegie: All of the cases specific to the royal commission have been closed and reimbursed. Obviously,

we went beyond those to identify, because there was an individual case, whether there were other examples of

that. We are still working through those. I think there are quite a number that are going to be closed out by

December, but we're also proactively continuing to look. Again, often it's got nothing to do with poor behaviour;

it's just—

CHAIR: Mistakes.

Mrs Carnegie: A mistake may happen. For example, I've just opened a remediation case because I found out

that for term deposits, if a term deposit term finishes on the weekend and a customer makes any kind of changes

to that term deposit over the weekend, we may not have been calculating the interest on that right. I just recently

discovered that. I think there's going to be an ongoing run of, hopefully, increasingly smaller and smaller

examples of things we find, but we're really trying to make sure that we find them quickly and remediate them

quickly as well. Again, there are going to be a few that are left over from December, and I'm happy to come back

to you on what those specific remediations are.

CHAIR: I'll follow up. Ms Lawrence asked a lot of questions about the AFCA cases, and so I'm interested in a

little bit of a breakdown of areas where there are cases, but we're also trying to look at it, for example, per

thousand customers, just to make sure we're normalising it in appropriate ways. I'm interested in what the trend in

the number of court cases that ANZ isn't—

Mr Elliott: Court?

CHAIR: AFCA is obviously the preferred route, where possible. It can't be used for all situations, but

sometimes things go into more formal legal proceedings—

Mr Elliott: It's a good question.

CHAIR: What's the five-year trend, say, and how many court cases are on foot at any point in time?

Mr Elliott: I'd have to take that on notice and come back to you. Thankfully, it's relatively modest. It's not a

big number, but I couldn't tell you what the trend is. I will come back to you on that. I don't have that off the top

of my head.

CHAIR: I'll put that to all the banks. I think I know the answer to this, but is ANZ formally committed to

being a model litigant?

ECONOMICS COMMITTEE

FOI 3766

Document 13

s22

From:

s22

Sent:

Tuesday, 10 September 2024 11:05 AM

To:

s22

Cc:

Subject:

RE: FW: BCIB media report [SEC=OFFICIAL]

Happy to leave this with you all – thank you. I suggest if any MCs come through on this they could be led by you too,

if ANZ/Suncorp text is needed please let us know.

Cheers,

s22

s22

Banking and Credit Unit – Banking and Credit Branch

Financial System Division

The Treasury acknowledges the tradi onal owners of country throughout Australia, and their con nuing connec on to land,

water and community. We pay our respects to them and their cultures and to elders both past and present.

LGBTIQ+ Ally

From: s22

@TREASURY.GOV.AU>

Sent: Tuesday, September 10, 2024 10:42 AM

To: s22

@treasury.gov.au>; s22

@TREASURY.GOV.AU>

Cc: s22

@TREASURY.GOV.AU>

Subject: FW: FW: BCIB media report [SEC=OFFICIAL]

OFFICIAL

Hey s22

– just flagging this ANZ Katoomba branch closure issue in addition to the BoQ branch closures

also recently announced.

I think the Regional Banking QTB should be updated QB24-000106. Guidance on PDMS suggests it can be updated

outside of 10am-4pm on a sitting day (parliamentary calendar).

s22

– this might be a good task for s22

. If he prepares cleared text perhaps we can drop it in

after 4pm or on Friday 13 Sep?

s22

OFFICIAL

From: s22

@TREASURY.GOV.AU>

Sent: Tuesday, September 10, 2024 9:30 AM

1

s22

s22

s22

s22

s22

s22

s22

s22

s22

s22

s22