Released by the Department of Finance

under the Freedom of Information Act 1982

FOI 24-25/057 (IR) - Document 1

ESTIMATES BRIEF – Hot Issue

EXTERNAL LABOUR SAVINGS

Budget Estimates – May 2024

EXTERNAL LABOUR SAVINGS MEASURE

Issue

The 2024-25 Budget measure

Savings from External Labour - Extension wil

achieve savings of $1.0 bil ion over four years from 2024-25.

Key facts and figures

•

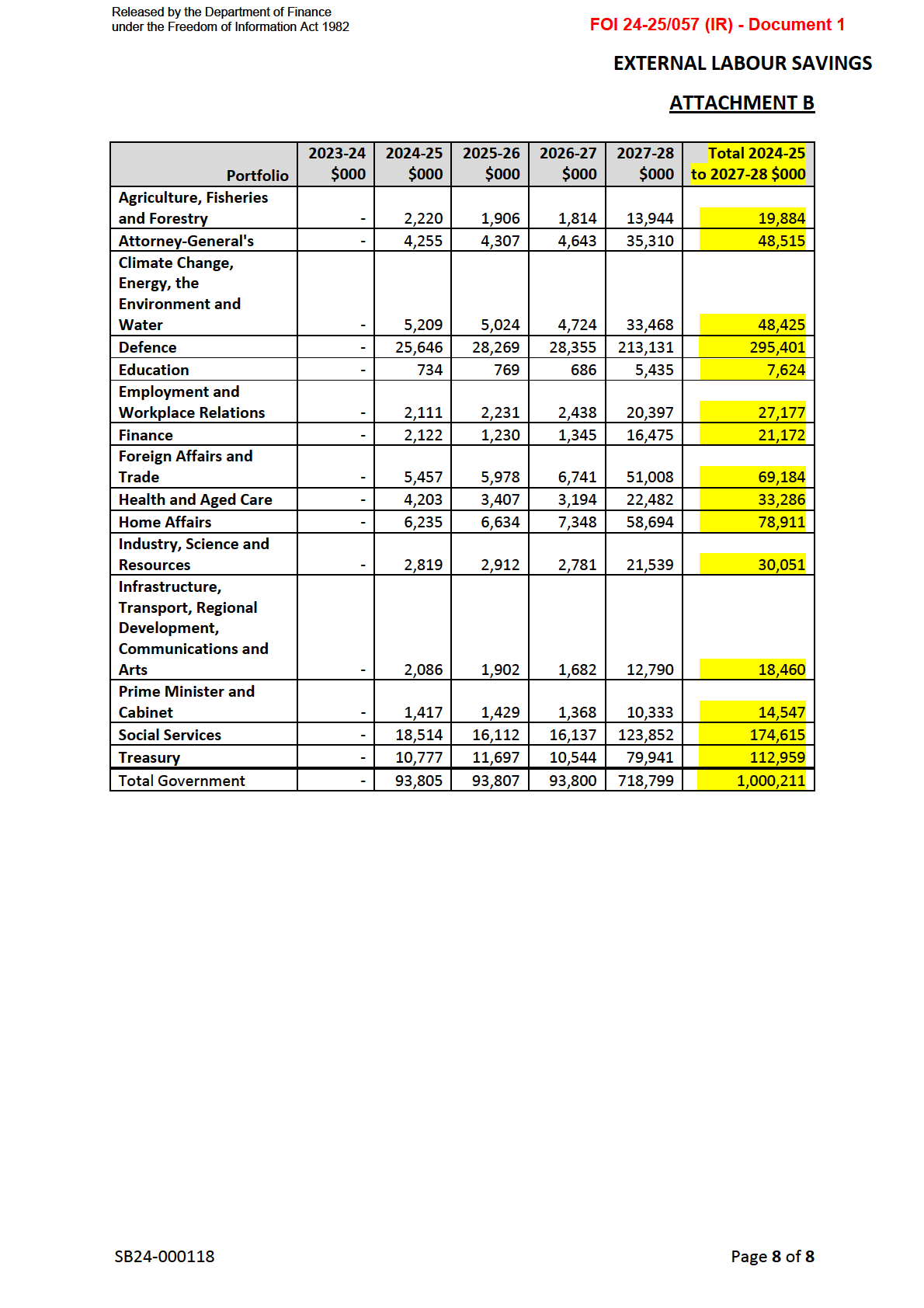

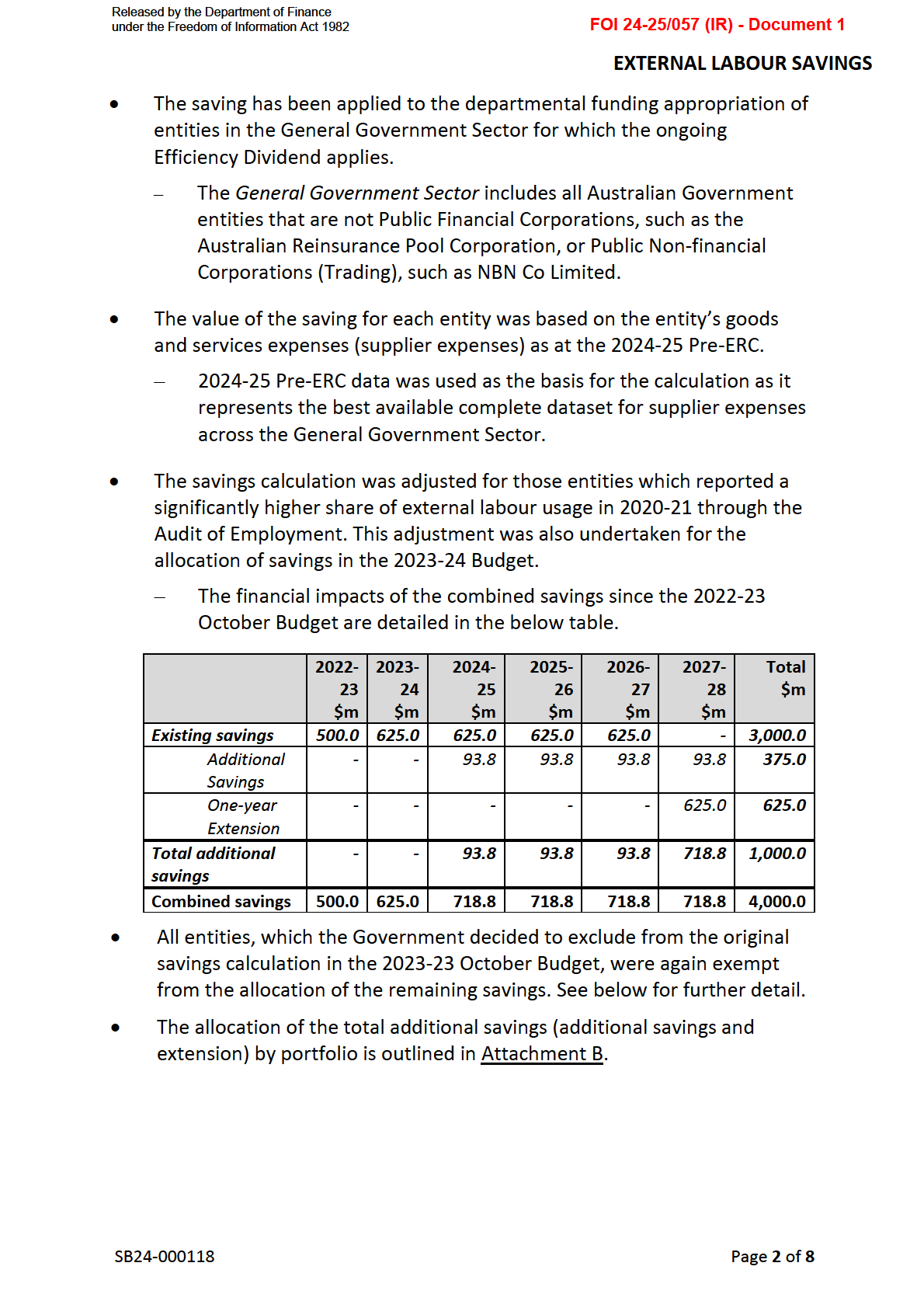

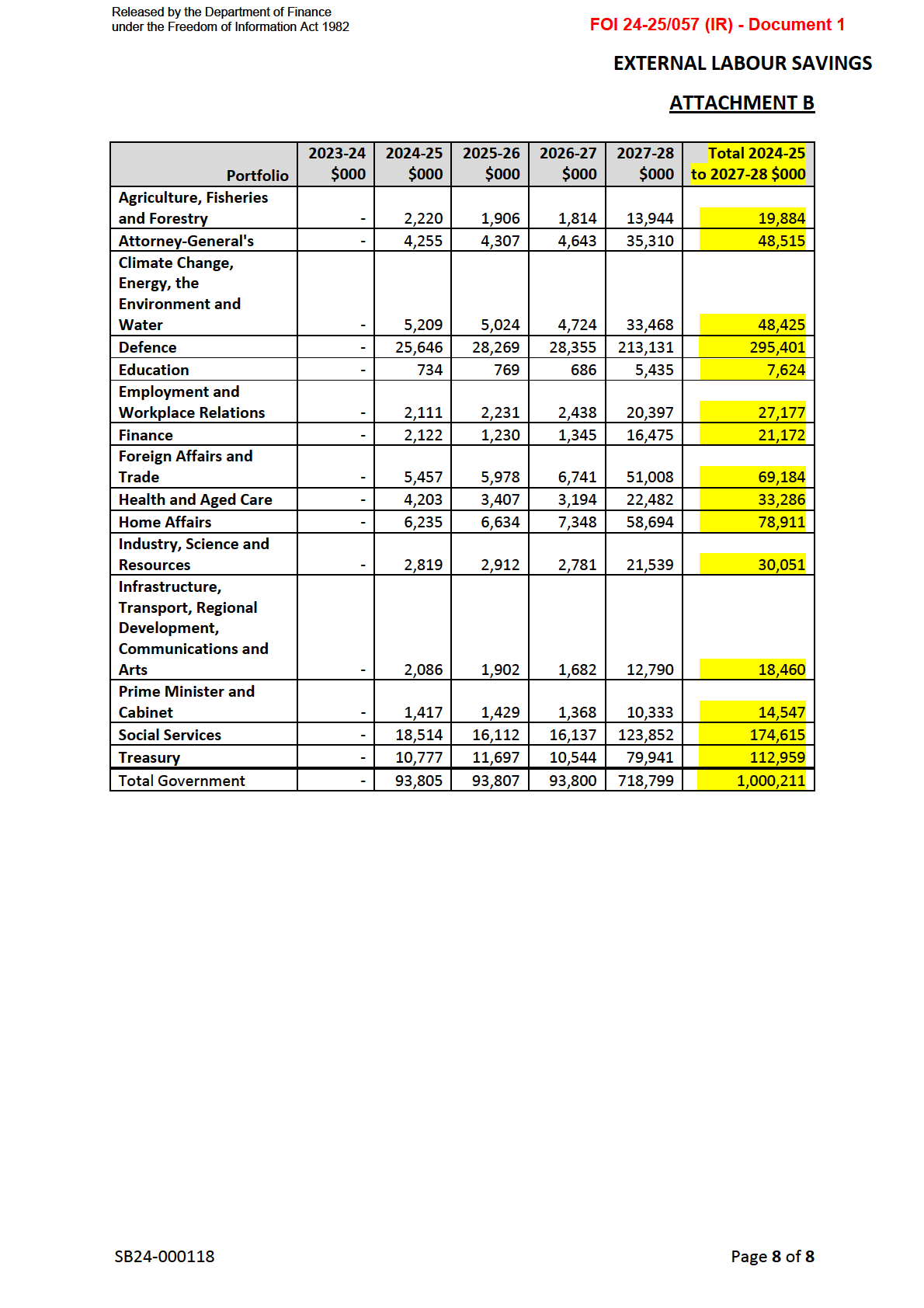

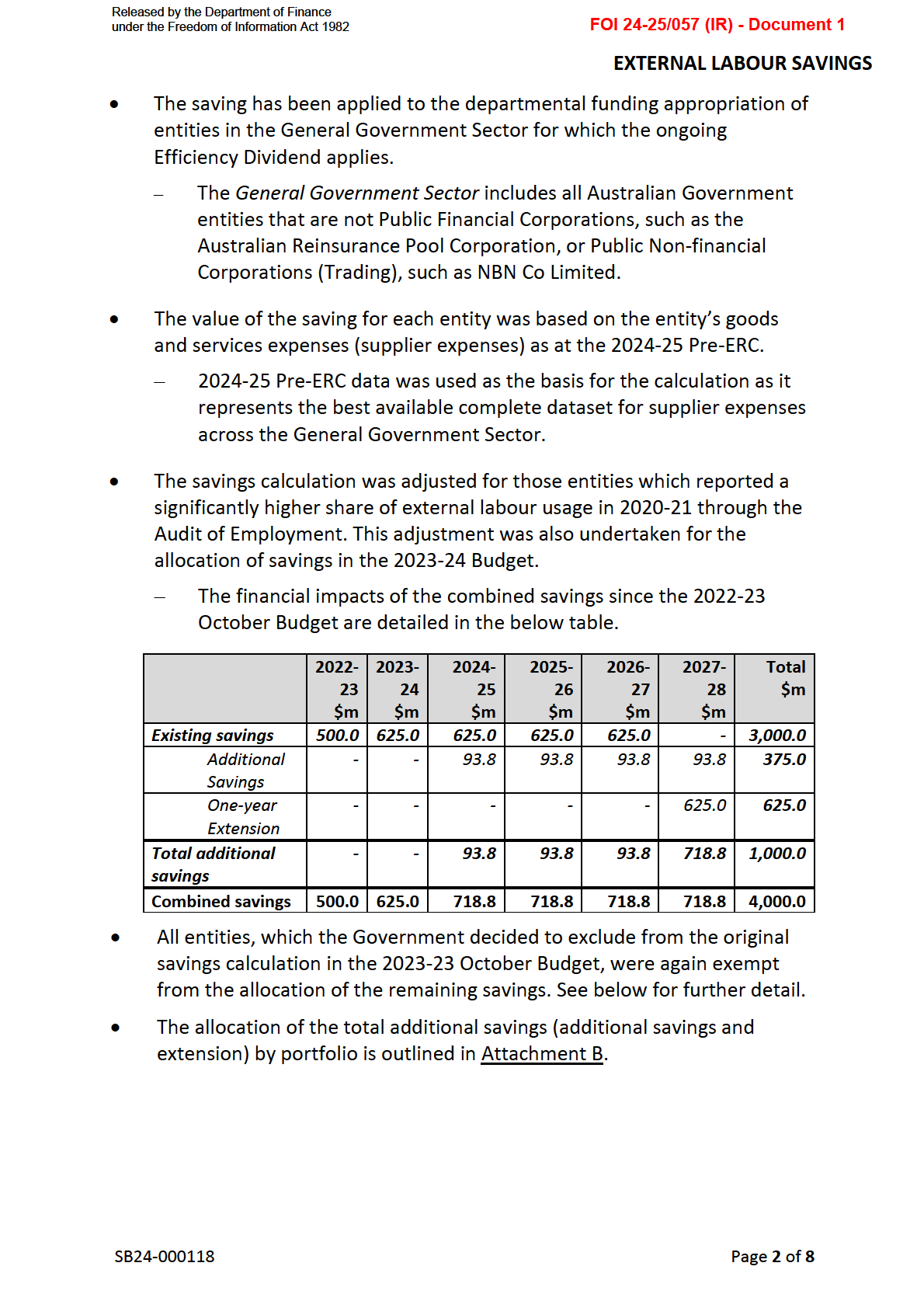

In the 2024-25 Budget, the Government wil deliver an additional saving

of $1.0 bil ion over four years from 2024-25 by further reducing spending

on consultants, contractors and labour hire (external labour).

–

The measure was announced by the Minister for Finance on Sunday,

5 May 2024 (Attachment A).

•

The $1.0 bil ion saving comprises:

–

a one-year extension of the existing external labour saving of

$625.0 million in 2027-28; and

–

an additional

$375.0 mil ion over four years ($93.8 million per year)

from 2024-25 to 2027-28.

•

This saving is in addition to the $3.0 bil ion in savings from external labour

from the 2022-23 October Budget measure

Savings from External Labour,

and Savings from Advertising, Travel and Legal Expenses (p. 83, 2022-23

October Budget Paper No.2). It

brings the total savings delivered by this

Government from reducing reliance on external labour sources to

$4.0 billion since 2022-23.

•

The Government wil also commission a second Audit of Employment in

the second half of 2024, to measure how the public service is delivering

on the Government’s commitment to reduce spending on external labour.

Key points

•

The additional external labour saving in the 2024-25 Budget was

calculated using the same methodology as the 2023-24 Budget.

SB24-000118

Page

1 of

8

Released by the Department of Finance

under the Freedom of Information Act 1982

FOI 24-25/057 (IR) - Document 1

EXTERNAL LABOUR SAVINGS

Background

In the 2022-23 October Budget, the Government delivered savings of $3.6 billion over four

years from 2022-23 through the Budget measure Savings from External Labour, and Savings

from Advertising, Travel and Legal Expenses. Of this, $3.0 billion savings were delivered

through savings from external labour.

The measure was implemented using a staged approach. The 2022-23 savings ($0.5 billion)

were allocated to agencies in the 2022-23 October Budget and were identified in the

measures table of individual Portfolio Budget Statements. The remaining savings ($2.5

billion) were allocated to agencies over four years from 2023-24 in the 2023-24 Budget

through estimate variations. The savings al ocation was included in the aggregates of al

Portfolio Budget Statements and some statements separately identified the savings as a

significant estimates variation.

For the 2024-25 Budget measure, the savings have been allocated to agencies and will be

identified in the measures tables of individual Portfolio Budget Statements (noting that some

portfolios may do so on a portfolio basis or on an individual agency basis).

Exemptions from savings

•

The Government decided to exclude from the savings calculations, the departmental

funding of the fol owing entities:

1. Agencies exempt from the ongoing Efficiency Dividend (ED) (including partial

exemptions).

2. Australian Security Intelligence Organisation (ASIO)

3. Australian Secret Intelligence Service (ASIS)

Consistent with other national security agencies that are exempt from the ongoing

Efficiency Dividend.

4. National Col ecting Institutions (NCIs)

a. Australian institute of Aboriginal and Torres Strait Islander Studies

b. Australian National Maritime Museum

c. Australian War Memorial

d. Museum of Australian Democracy at Old Parliament House

e. National Archives of Australia

f. National Film and Sound Archive of Australia

g. National Gallery of Australia

h. National Library of Australia

i. National Museum of Australia

j. National Portrait Gallery

5. High Court of Australia

6. Australian National Audit Office (ANAO)

7. Domestic, Family and Sexual Violence Council (DFSVC)

8. National Anti-Corruption Council (NACC)

9. Parliamentary Departments

a. Department of Parliamentary Services

b. Department of the House of Representatives

c. Department of the Senate

d. Parliamentary Budget Office

SB24-000118

Page

3 of

8

Released by the Department of Finance

under the Freedom of Information Act 1982

FOI 24-25/057 (IR) - Document 1

EXTERNAL LABOUR SAVINGS

Supporting information

Questions on Notice

2023-24 Budget Estimates (May 2023)

•

F107 – Finance and Public Administration Legislation Committee,

Senator Simon Birmingham – Senator Birmingham made several requests for

information related to how DFAT was able to achieve the required savings. The

response referred to answers for F024 and F064 (below) for some questions, and

directed that other questions are the responsibility of the accountable authority.

Tabling date: 6 July 2023.

•

F024 – Finance and Public Administration Legislation Committee,

Senator Jane Hume – Senator Hume requested an updated profile (fol owing the

extension to 2026-27) of the savings al ocation by department. The response

provided the updated al ocation at a portfolio level and referred to the calculation

methodology. Tabling date: 6 July 2023.

2022-23 Supplementary Budget Estimates (February 2023)

•

F026 - Finance and Public Administration Legislation Committee,

Senator Jane Hume – Senator Hume requested an agency breakdown of the 2022-

23 al ocation of the saving as wel as the details of how much of the $3.6 billion is

associated with external labour, advertising, travel, and legal expenses. The

response referred to answers for F011 and F053 (below). Tabling date: 31 March

2023.

2022-23 Budget Estimates (October-November 2022)

•

F011 - Finance and Public Administration Legislation Committee, Senator Dean

Smith – Senator Smith requested the agency breakdown of the 2022-23 allocation

of the saving. The response noted that the 2022-23 allocation can be found in

Portfolio Budget Statements. Tabling date: 22 December 2022.

•

F064 – Attorney General’s Department Measure Savings, Senator Paul Scarr –

Senator Scarr requested details of how the saving was calculated. The response

noted it was calculated as a levy based on historical information (for advertising,

travel, and legal) or based on goods and services expenses (external labour). Tabling

date: 22 December 2022.

•

F053 – Finance and Public Administration Legislation Committee, Senator Barbara

Pocock – Senator Pocock requested a breakdown of how much of the $3.6 bil ion is

attributed to external labour, advertising, travel and legal expenses over the

forward estimates. The response was provided consistent with the October Budget

allocation of the saving. Senator Pocock further requested the overal spending on

consultants across the APS for the last 10 years. The response was taken from

AusTender with a total value of $5,639.6 million over 10 years on consultancy

contracts. Tabling date: 16 December 2022.

•

In addition, several other portfolios received QoNs regarding how allocations for

individual agencies were calculated.

Freedom of Information (FOI) Requests

•

No FOIs asked.

SB24-000118

Page

4 of

8

Released by the Department of Finance

under the Freedom of Information Act 1982

FOI 24-25/057 (IR) - Document 1

EXTERNAL LABOUR SAVINGS

Recent Ministerial Comments

•

Nil

Relevant Media Reporting

•

Labor saves $1 billion by bringing public servants back in-house – The Canberra

Times and Inner East Review – 4 May 2024.

The article provides a breakdown of the $1.0 bil ion savings from external labour,

emphasising the continuation of the previous savings. The conversions since the

2022 election, new Audit of Employment and the reduced spending on external

labour to date are highlighted.

•

Rebuilding and rebalancing APS – The Canberra Times – 6 May 2024.

The article provides the Finance Minister’s insight into the former government’s

reliance on external labour and measures taken to rebuild the public service.

•

Gal agher hits APS agencies with new outsourcing tax – The Mandarin – 5 May

2024.

The article provides a breakdown of the $1.0 bil ion savings from external labour,

emphasising the continuation of the previous savings. The conversions to date and

expected conversions in the 2024-25 Budget is highlighted and a reference to the

new Audit of Employment is made.

•

Tax take surges as budget surplus within reach – INDAILY – 6 May 2024.

The article mentions the Government will deliver $1 billion in savings on

consultants and contractors in the context of a potential budget surplus.

•

Big four in firing line for $1.6b cuts to consultants, lawyers – The Australian

Financial Review (AFR) – 18 July 2023.

The article provides a breakdown of the savings from external labour, advertising,

travel and legal by portfolio from 2023-24 to 2026-27. Finance Minister is quoted

on the entrenched use of consultancies and external labour in the public service the

steps taken to wind back the overreliance of external labour.

-

Note: the breakdown of savings by portfolio is consistent with information

provided in QoN F024.

Date:

16 May 2024

Cleared by (SES):

Simon Writer

Telephone No:

02 6215 3966

Group/Branch:

Budget Policy & Data Division

Contact Officer:

s22

Telephone No:

Consultation:

Nil

PDR Number:

SB24-000118

Last Printed:

11/07/2024 11:40 AM

SB24-000118

Page

5 of

8

Released by the Department of Finance

under the Freedom of Information Act 1982

FOI 24-25/057 (IR) - Document 1

EXTERNAL LABOUR SAVINGS

ATTACHMENT A

MEDIA RELEASE

5 May 2024

LABOR TO ACHIEVE AN ADDITIONAL $1 BILLION IN SAVINGS

FROM CONSULTANTS AND CONTRACTORS

The Albanese Labor Government wil deliver a further $1 bil ion in savings from

reducing spending on consultants, contractors, and labour hire in the 2024-25

Budget. This is part of the Government’s commitment to reduce the reliance on

external labour and rebuild a fit-for-purpose public service that is resourced to deliver

the services Australians expect.

This save is in addition to the $3 bil ion in savings from reducing spending on external

labour that the Government delivered in the 2022-23 October Budget, bringing the

total savings delivered to $4 bil ion.

The Government wil also undertake a second Audit of Employment to measure and

track exactly how the public service is delivering on the Government’s commitment to

reduce its reliance on external labour.

Since the election, there are around 8,700 roles that were done by contractors or

labour hire that are now being performed by public servants. This includes an

additional 2,400 conversions to be reported in the 2024-25 Budget.

The use of the biggest consulting firms has significantly reduced under the Albanese

Government, dropping by $624 mil ion year-to-date this financial year compared to

the comparable period in 2021-2022. Public servants are now doing this work that

was previously outsourced.

Minister for Finance and the Public Service, Senator the Hon Katy Gallagher, said

that instead of relying on a more expensive outsourced shadow workforce, the

Albanese Labor Government is rebuilding the public service to do the job the

Australian people expect.

“While the Liberals talked tough about capping public service numbers when they

were in government, in reality they were spending bil ions outsourcing the work to

keep the public service headcount artificially low,” Minister Gallagher said.

“The important investments that we’ve made in Services Australia, Veterans’ Af airs,

the NDIA, Home Af airs and AUKUS are to ensure that the public service has enough

staff to do the job they need to do to deliver services across the country and to keep

Australians safe.”

SB24-000118

Page

6 of

8

Released by the Department of Finance

under the Freedom of Information Act 1982

FOI 24-25/057 (IR) - Document 1

EXTERNAL LABOUR SAVINGS

“Two years into the public service rebuild, it’s no surprise that the Liberals are already

drawing up plans to cut at least 10,000 public servant jobs and reduce services. It is

clear Peter Dutton wants to go back to the era of Robodebt and slash the services

that Australians rely on.”

The $4 bil ion external labour save wil comprise $625 mil ion allocated across all

government agencies in 2027-28, consistent with the approach taken in the October

Budget, plus an additional external labour levy of $375 mil ion over four years from

2024-25.

The first Audit of Employment showed that the former Government spent

approximately one in every $4 on external labour in 2021-22. At the same time as

reducing the services Australians rely on, the Liberals employed a shadow workforce

of tens of thousands of private consultants and contractors to keep the size of public

service artificially low.

The actions the Albanese Labor Government is making to rebuild the public service

and reduce the reliance on consultants and contractors recognises that delivering

outcomes for Australians must be built on the foundations of a strong public service.

SB24-000118

Page

7 of

8