Document 1.1

Document 1.3

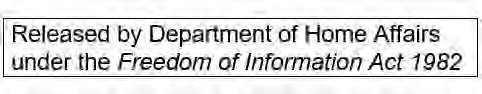

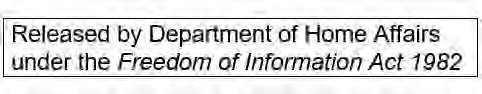

OFFICIAL: Sensitive

Personal privacy

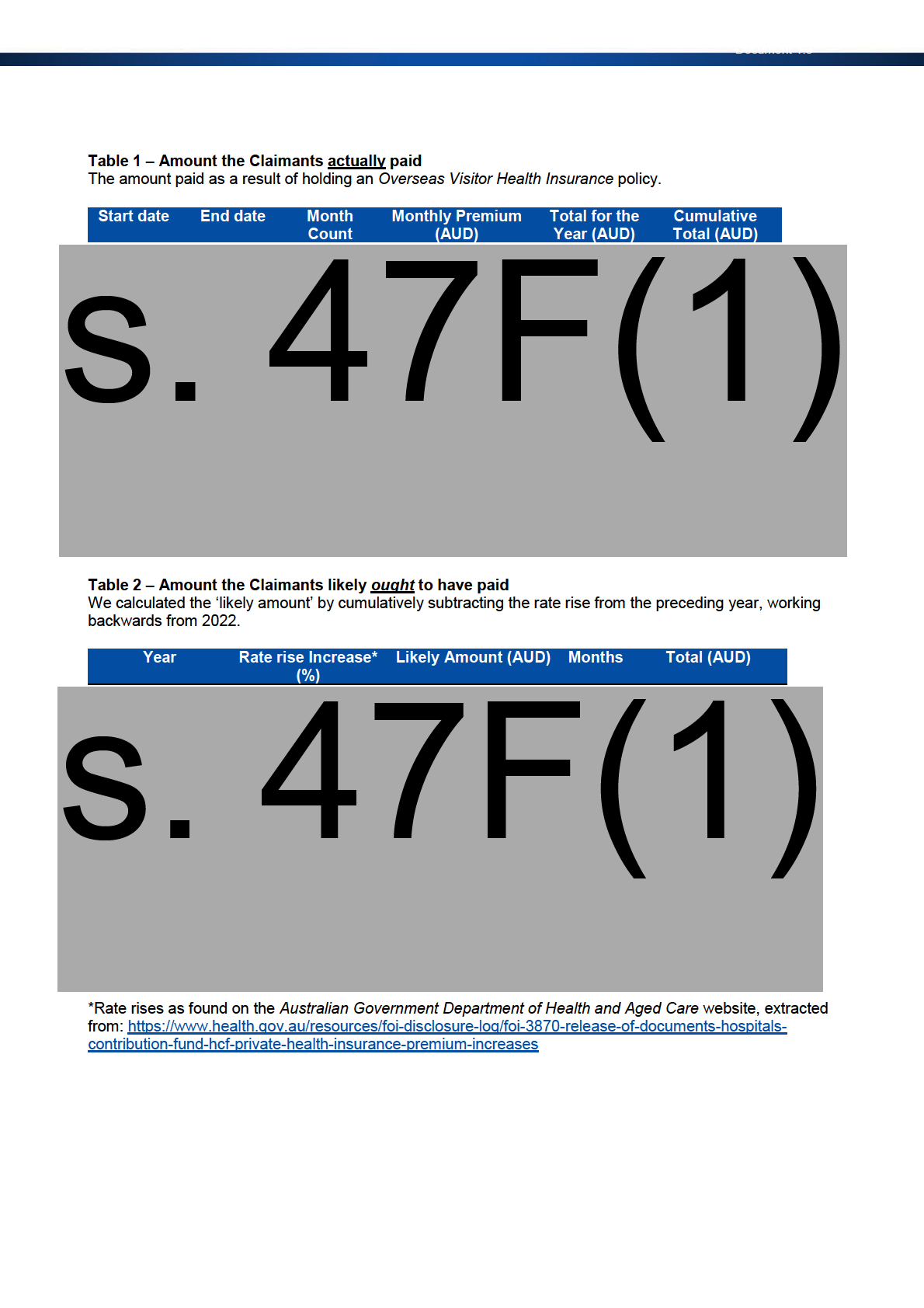

Attachment C - Calculations of Health Insurance Costs

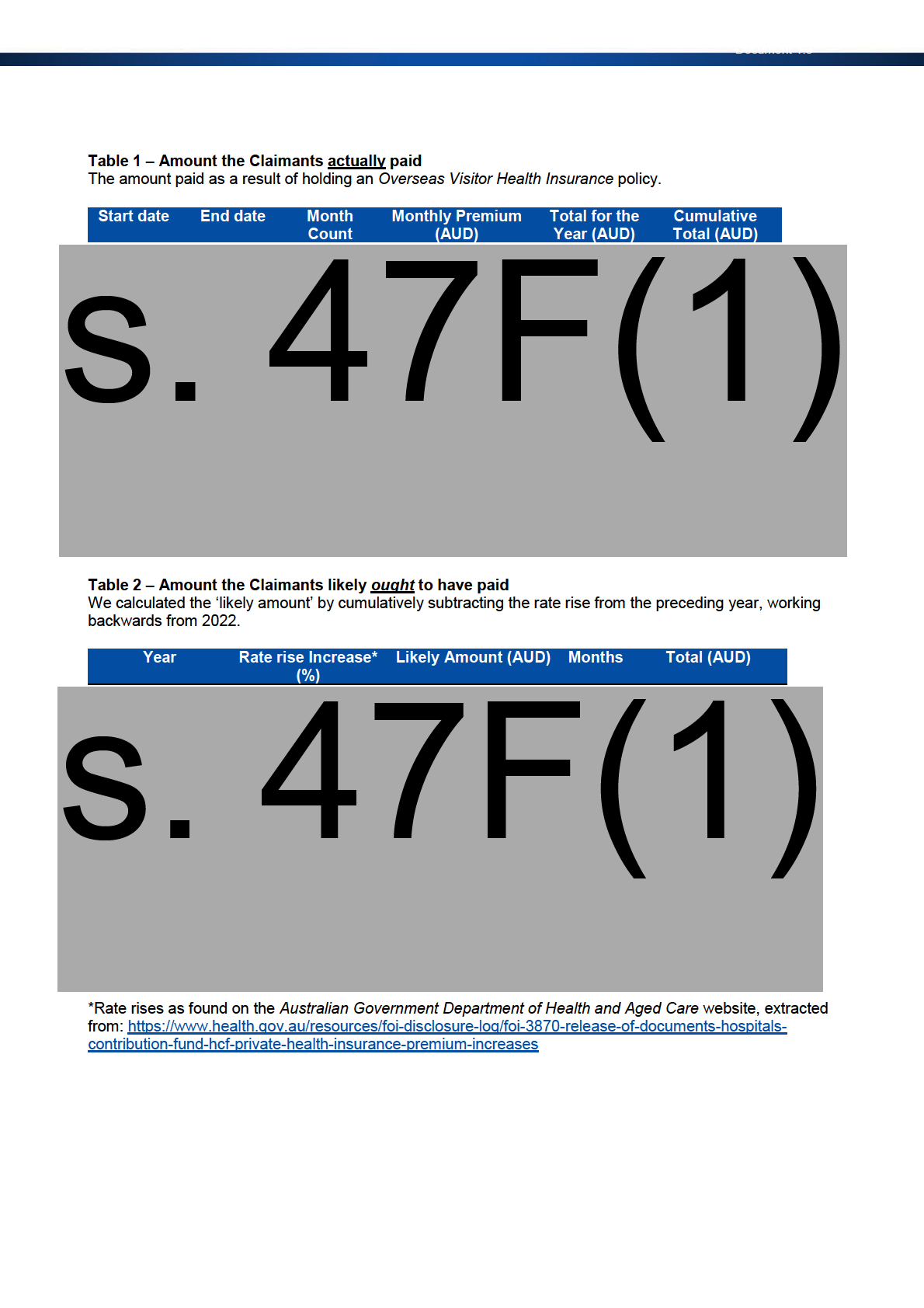

The amount the Claimants actually paid

1. The Claimants had paid AUDs. 47F(1) between s. 47F(1)

(see

Table 1). We calculated this amount based on the following:

a) The Claimants’ BVA came into effect in s. 47F(1) (at the expiry of their Retirement

visa), and therefore considered this as the starting point of detriment suffered; and

b) The sum of all the premiums paid between s. 47F(1)

based

on rate rise letters provided by the Claimants.

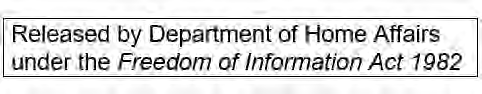

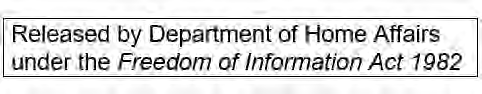

The amount the Claimants ought to have paid

2. Had the Department’s defective administration not occurred, we calculate that the

Claimants were likely to pay a ballpark figure of AUDs. 47F(1) in premiums (see

Table 2).

We arrived at this amount be considering the following:

a) The Claimants confirmed that they now pay AUDs. 47F(1)

in health

insurance premiums per month;

b) We deducted s. 47F(1) yearly rate rises cumulatively against AUDs. 47F(1) to estimate

the likely monthly premium from year to year; and

c) Multiplied the likely monthly premium by the number of months between s. 47F(1)

3. s. 47C(1)

However, the CDDA guidelines provides that offers of compensation are calculated

on the basis of what the decision maker considers is fair and reasonable in the

circumstances.

4. Based on the above, we calculate the amount payable to be AUDs. 47F(1)

(being the

difference of the underlined values above).